- Solution overview

How to re-energize your customer onboarding

As digital disruption takes hold and customer expectations increase, leading financial institutions (FIs) are shifting their focus to customer experience and service in an attempt to engage their customers and create value for them as never before. Many FIs recognize that first impressions count – and that onboarding can help make that first impression a good one. It’s now a priority to re-invigorate digital onboarding and origination processes.

Challenge

Exceed customers’ expectations in an increasingly demanding world

Most FIs get it: Clients today want simple, seamless digital experiences. At the same time, most FIs are running disjointed processes on different technologies, which makes it harder for them to gather and use customer information and intelligence. To address these challenges and gain a competitive advantage, FIs are looking for ways to leverage digital capabilities – and onboarding enhanced by those capabilities is increasingly being viewed as a way to create happier customer journeys from the outset. That’s where Genpact can help.

Solution

Genpact consumer banking onboarding

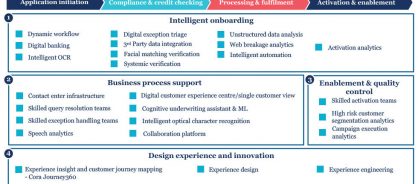

We offer a digital onboarding solution powered by our proprietary artificial intelligence platform Cora and built on robotic process automation (RPA), computational linguistics, analytics, and dynamic workflows. Whether FIs are taking an end-to-end or modular approach, we combine our onboarding solution with our business process expertise, customer service infrastructure, and omnichannel support to transform complex processes. These modules, which can be integrated with other third-party solutions, deliver the goods.

The intelligent onboarding module

Customers can start the onboarding process through digital banking platforms, such as an application on their personal computers, tablets, or mobile devices. The intuitive user interface supports dynamic smart forms, which eliminate the need for applicants to repeat information and streamlines the data-entry process. A digital assistant also prefills appropriate fields to further reduce data input. A dynamic workflow combined with optical character recognition can automate the validation income and expenditure information from a customer. And our image-capture utility extracts relevant data from uploaded ID documents. Finally, our digital decisioning assistant automates the review and validation of customer data with third-party and government data sources.

This is all underpinned by dynamic workflows, which coordinate each customer’s onboarding or origination engagements. The workflow engine applies complex business rules to help sequence decisions and actions that are relevant to these processes. In very complex cases, where manual processing may still be required, the module supports exception handling for know your customer (KYC), antimoney laundering (AML) cases, documentation, and credit decisioning. Embedded RPA, which integrates with banking systems for setting up customer accounts, automates the process of creating accounts and generating contracts

Figure 1: Genpact consumer banking onboarding solution comprises of a range of industry leading capabilities, brought together into a coherent whole

The business process support module

Our customer service infrastructure provides omnichannel customer support and query resolution. Customers don’t have to leave the channel they’re in to get the assistance they need – and a notification engine regularly updates their status. A chat advisor with intelligent, cognitive capabilities offers dynamic insights and recommends answers so that customer service personnel can better respond to inquiries. The chat advisor can help assess customer moods and even suggest phrases and terms to deliver an optimized tone of voice. A digital assistant can support or automate underwriting. And when underwriting scenarios fail, the module makes it easy to refer the problem forward.

The enablement and quality checking module

Industry-leading activation and validation processes identify customers who are likely to become dormant or at risk of being mis-sold. Once identified, banks can use the module’s integrated campaign creation and initiation capability to set up targeted outreach to customers. This can also include skilled activation and sales compliance checking teams for proactive outbound interactions. All of this will reduce dormancy rates and significantly mitigate the risk of regulatory fines.

Digital experience and innovation module

We enable banks to transform customer experience through a design-led approach, and we build intelligence into both customer experience and product design:

- Experience design: Using customer journey maps, we identify opportunities for innovation and generate ideas for the future state. We help banks with ideation and design for systems, frameworks, and products. The most promising ideas are prototyped and tested iteratively with real users.

- Experience engineering: We implement the approved prototypes and develop and validate concrete plans for roll out.

We deliver transformed customer experience, improved efficiencies, greater productivity – and intelligence you can use

With Genpact’s modular solution, banks can transform the end-to-end customer experience while improving onboarding and origination performance objectives.

Here are just some of the benefits banks can enjoy.

Improved customer experience

- Better net promoter scores and greater product cross sell

- Reduced application data entry time per customer

- Fewer documents for customers to upload

- Shorter application activation time, resulting in less waiting time for customers and fewer drop-outs

Visit our consumer banking page

Greater process efficiency

- Cut turnaround time for creating accounts from days to hours

- Improved overall accuracy with the introduction of RPA and cognitive capabilities

- Reduced turnaround time for exceptions handling

- Greatly improved middle- and back-office cycle times

Case study

A leading Australian retail bank

A leading Australian retail bank wanted to accelerate onboarding, increase card usage and enhance customer experience. However, it was struggling with legacy IT systems and poorly executed front-end processes. Our consumer banking onboarding solution helped the firm to:

- Improve its card open rate by 8% and add more customers

- Reduce the time to issue cards by 50%, leading to a multi-million dollar cash flow increase

- Boost its conversion rate by 8%

- Shorten the cycle time of customer requests

- Achieve a multi-million dollar increase in added annual card spend

Why Genpact?

Genpact is a global professional services firm that makes change real for companies. We think with design, and solve problems with data, digital, and experience. For financial services firms looking to transform their customer onboarding, our digital onboarding solution, which Gartner singled out for its effectiveness, integrates our deep domain knowledge with leading AI technology to transform customer experience across the front, middle, and back office.