- Point of view

Thriving through inflation

How CFOs can embed intelligence to build resilience and growth beyond disruption

Business confidence was on the up. With the pandemic in the rear-view mirror, enterprises were gearing up to focus on innovation and growth. But while still in recovery mode, enterprises across industries were confronted by a different kind of disruption – inflation. And as energy prices rocket, supply chain disruption and labor shortages worsen, and a geopolitical crisis intensifies, finance teams are looking at tackling turbulence well into 2023.

Though we know hiking prices and absorbing costs are traditional tactics used to minimize the impact of inflation, they only work in the short term. The most successful enterprises are those with embedded intelligence and predictive insights that allow CFOs to connect their entire business ecosystem internally and externally and navigate their organizations through choppy financial waters and toward long-term gains.

Inflation is here, it's time to look ahead

Globally, inflation across Organisation for Economic Co-operation and Development (OECD) countries surged to 10.5% in September 2022. And US government figures show that the Consumer Price Index for all urban consumers over the 12 months ended June 2022 increased 9.1 percent — the largest 12-month increase in 40 years. Unsurprisingly, then, CFOs and their C-suite colleagues have bumped inflation to second on their list of external threats from 22nd a year ago2.

This kind of disruption naturally elicits knee-jerk reactions. Consumer behaviors change, demand fluctuates, price sensitivity goes up, and customers and manufacturers look at product substitutions and supplier alternatives. However, tomorrow's market leaders will be those who think beyond the short term and instead consider long-term wins.

Just consider how the pandemic accelerated the need for digital transformation. Those enterprises that had already invested in robotic process automation, artificial intelligence (AI), cloud technology, and collaboration tools faced fewer challenges, with built-in intelligence and the agility to act rapidly. C-suite leaders must heed this lesson and invest now to future-proof their business.

The shortsighted survive while those with foresight thrive

Across industries, enterprises need to find new ways to get ahead of economic upheaval. CFOs can review their debt strategies, hedge against fluctuating currencies, and manage portfolio investments. But they will also look to see where they can absorb costs or pass them on to others. And this is where CFOs should recalibrate to focus on intelligence-driven tactics, using forecasting, stress testing, and scenario planning to isolate high-risk factors at their source and find new ways to grow.

The companies hit hardest by inflation are those that depend on raw materials and components, such as construction, manufacturing, technology, pharmaceuticals, and consumer goods. Retail is also feeling seismic shifts. Let's consider some of the industries most impacted:

- Pharmaceuticals: reducing drug prices saves lives. Inflation could get in the way of affordability and health equity to reduce the counterfeit and gray market. Instead, life sciences companies should focus on embedding automation and intelligence at the R&D and approvals stages to bring down costs and speed drugs to market. They can, for example, automate data processing with AI, use data simulation to reduce clinical trial time, or collaborate with competitors to innovate. COVID-19 vaccine development has shown just how powerful these tools are in not only accelerating time to market, but also building public trust

- Manufacturers: ensuring supply chains are sustainable and ethical as well as cost-effective is paramount. Short-term gains made from sourcing cheap labor, suppliers, and materials in response to inflation will likely cause long-term damage to brand reputation, both as an employer and supplier. Leading manufacturers instead use intelligence to design a proactive strategy for sustainable sourcing that balances both purpose and performance to give them the competitive edge

- Retailers: the quick win is to pass on costs. But companies risk pushing customers to cheaper alternatives, and if they lose brand loyalty, it's hard to win it back. Playing the long game and thinking ahead to automate fulfillment, re-evaluate supply chain and logistics, and negotiate with suppliers in return for market share will soften the blow while ensuring consumers don't feel the shock and lose faith

As the above examples illustrate, embedding intelligence not only has the power to minimize the impact of near-term disruption, but also to build more resilience to current and oncoming disruptions and improve long-term outcomes. Enterprises need to invest in mid- to long-term agility enabled by digital transformation.

Three ways to combat inflation and build resilience

To be proactive and prepared, leading CFOs are investing in systems integration, streamlining processes, and delivering data that powers predictive insights to accelerate decision-making. In this way, they are not only able to respond to disruption, but also build resilience through sustainable, ongoing gains. Here's how:

1. Improve forecasting and stress test

Inflation brings big changes, fast. Accurate forecasting, enabled by AI-powered predictive analytics and machine learning (ML) is vital to not only withstand economic turbulence, but also grow within and beyond it.

Confronted by rapid price hikes, CFOs can struggle to accurately predict what's coming. Especially if they are dealing with legacy systems, manual processes, and dispersed data. Not to mention the fact that many of today's CFOs haven't had to deal with inflation before now.

Enter intelligent technologies. They harness internal and external third-party data to accurately forecast demand, profit and loss, supply chain issues, and much more. These real-time insights enable CFOs to act decisively to tighten costs and cash management.

Finance teams can scenario and stress test based on external threats and identify savings and risk – both short and long term – based on these insights. They can create formulas for the knock-on impact on the key financial metrics that keep investors and stakeholders in the loop.

Case study: A confident cash position

For a leading global medtech company, poor data and forecasting capabilities meant low confidence in its day-to-day cash position. Forecast variations of more than $350 million on cash disbursements of around $10 billion per month meant the company was repeatedly missing cash forecasts by a significant amount. And the subsequent, short-term borrowing costs at the end of the period were proving very high.

Genpact helped consolidate the process across all business units to predict cash inflow and outflow. We introduced automated predictive models for more accurate daily data on invoice, cash discounts, and chargeback projections. The model allowed the finance team to visualize different input scenarios, factoring in the latest data with ease. The improved forecast accuracy of the company's cash position cut the average forecast variance in half and drove down annual borrowing costs.

2. Intelligent sourcing to boost purchasing power

Inflation erodes purchasing power. Using forecasting, CFOs can partner with chief product officers (CPOs) to buy goods and services – predicted to increase in price – now, for future use. The key here is to weigh expected price increases against the cost of financing and carrying extra inventory and consider the risks of excessive overstocking and committing to long-term agreements on services.

Intelligent sourcing strategies are key. Predictive analytics can help forecast demand as well as supply shortages and price increases in materials in real time. Technologies such as AI and ML can process numerous bills of materials for every product. When analyzed alongside historical sales data and external data such as macroeconomic factors, enterprises have the foresight to predict fluctuations and establish the material quantities needed for the coming 12 months and beyond.

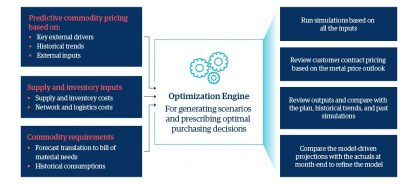

Let's look at how this works in practice. For a manufacturer purchasing different grades of metal, a robust AI-driven analytical model digests all the key internal and external factors influencing metal price and demand to create an accurate real-time forecast. Predictive intelligence on metal pricing and demand, supply and inventory costs, and materials requirements feed into a scenario planning optimization engine (figure 1). The engine isolates the risks associated with holding excess stock and inventory and tying up cash. Stakeholders can then make better-informed decisions as to whether to buy materials and components in advance.

Figure 1: Scenario modeling optimization engine for metal purchasing decisions

The optimization engine outputs lay a solid foundation for negotiating with suppliers, establishing consignment programs, altering payment terms, and partnering with competitors to boost buying power and product availability through shared resources.

3. Be innovative in your tactics to influence consumer behavior

In December 2021, US retail sales sank 1.9% month-over-month, for the biggest decline since February 20213, UK retail sales volumes fell by 3.7%4, and in India they fell 2%5. This hit particularly hard because it followed months of strong growth. The threat of the Omicron COVID-19 variant plus the surge in inflation made shoppers more conservative in their spending than expected.

With intelligent inventory forecasting, CFOs are partnering with sales and marketing to respond quickly to changes in demand. AI and ML technologies make predictions based on the patterns they spot within customer sales and loyalty program data, real-time pricing and promotions tracking, price elasticity, and external market intelligence. These insights improve customer segmentation to deepen existing customer relationships and loyalties and identify potential new markets, which can more than double short-term promotion effectiveness. Tailoring and targeting promotions and hyper-local inventory assortments can drive up basket size and finding new channels for sales and customer services can widen the customer base.

CFOs can also champion innovation with data-led insights to support new ways to influence consumption patterns. For example, at-shelf monitoring automatically re-prices products nearing expiry or on promotion to reignite customer desire and encourage people to switch products and brands.

Case study: Forecasting promotions effectiveness to create a competitive advantage

A US retail grocer needed to find a way to respond to changing customer demands and competitor promotions. But with 300,000 products across 80 categories, it struggled to come to grips with its sales and marketing data to know what offers to run and when.

Genpact harnessed its point-of-sale and promotions data together with seasonal indexes, trend calculations, assortment variables, and competitor product selection data to give the business a clear view of baseline and incremental sales across its entire product range. And it built a predictive model to help the business anticipate and quickly react to competitor tactics and design promotions based on buying behaviors. Scenario modeling insights on promotion performance, sales volumes, and fulfillment, and cannibalization of full price sales gave the retailer the agility to adapt and switch promotions on and off as needed to realize far greater returns.

Act now for long-term gains

Inflation is here. Short-term solutions are often shortsighted in the face of today's inflation challenge. The CFOs with full 20/20 vision are empowering their C-suite with predictive intelligence to pivot operations and cash management quickly and confidently. This readies enterprises to act without deviation from plans for innovation and growth, even amid the most unexpected and turbulent of disruptions.

Thwart inflation with predictive intelligence

1. https://www.oecd.org/newsroom/consumer-prices-oecd-updated-3-march-2022.htm

2. https://www.conference-board.org/pdfdownload.cfm?masterProductID=38504

3. https://www.nytimes.com/2022/01/14/business/retail-sales-december.html

4. https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/december2021

5. https://www.bloombergquint.com/business/retail-sales-growth-slows-in-december-amid-omicron-led-curbs