- Point of view

Making the case for digital in claims

How insurers are investing in digital and reaping the rewards

With insurers facing significant headwinds, claims leaders must make a strong business case for digital investment. Understanding the full potential of advanced technologies and how they support claims priorities is an important first step.

Traditional insurers are facing a fight for survival. Insurtech challengers, unencumbered by legacy systems, are eroding their customer base with a seamless customer experience that pays claims in a fraction of the time. New sources of data such as driverless cars, telematics, and wearable devices need to be plugged into their existing systems to help price risk and assess losses. They must embrace the digital technologies that also threaten them to simplify claims processes, improve customer service, and sharpen their competitive edge. Claims leaders must choose digital investments that balance speed of payment, accurately estimate losses, and control expenses.

We quizzed over 60 senior executives in the insurance industry on their experience of transforming claims using digital technology, the impact on customer satisfaction, the wider business benefits, and their claims priorities over the next two years.

Does the technology live up to the hype?

A resounding yes. Nearly three quarters of our respondents told us digital technology really helps them transform claims.

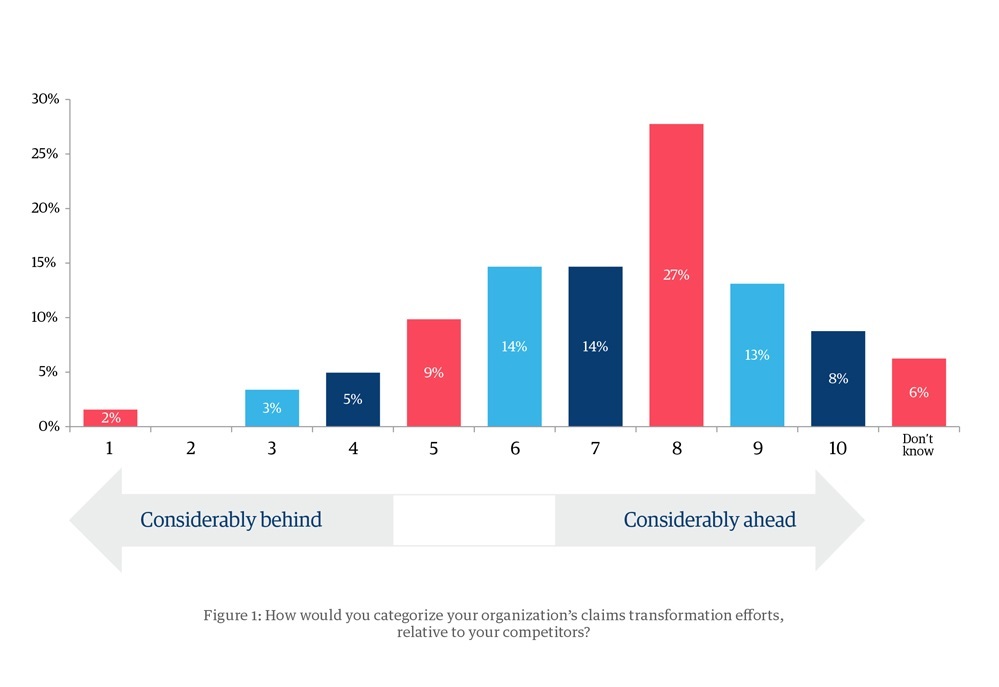

But there’s still a way to go. When we asked how they’re doing compared to their competitors, the majority think there’s still room for improvement for their claims offering. Even if they have already adopted new technologies, the pace of digital innovation and demands from customers for a seamless omni-channel experience mean it’s hard for insurers to keep up.

No surprise then that only 8% have nailed it and think they are ‘considerably ahead’ of the pack (figure 1).

Figure 1: How would you categorize your organization’s claims transformation efforts, relative to your competitors?

The link to customer satisfaction is real

Our respondents’ investments in new technology are keeping customers happy. Over three quarters believe their customers are more than satisfied with their claims experience, with speed of settlement and proactive updates on a claim’s status believed to have the biggest impact on satisfaction levels. The trick for insurers is to know which technologies will address their specific customer experience issues.

Analytics fires up performance

Insurers have tonnes of data that – with the right approach to analytics– translates into a competitive advantage. It can help price risks accurately, detect fraud, and develop new products. Insurers that use analytics are reaping the rewards. Over three quarters of the respondents say it provides actionable insight about their processes, and improves both customer and business outcomes (figure 2).

How does analytics impact your organization’s performance?

Fighting the fraudsters

Fraud costs the US insurance industry tens of billions of dollars each year – a massive $400-700 per family in increased premiums. Reducing it is a huge opportunity for insurers to manage their expenses, but as criminals develop increasingly sophisticated insurance scams, insurers must use cutting-edge digital tools to fight back.

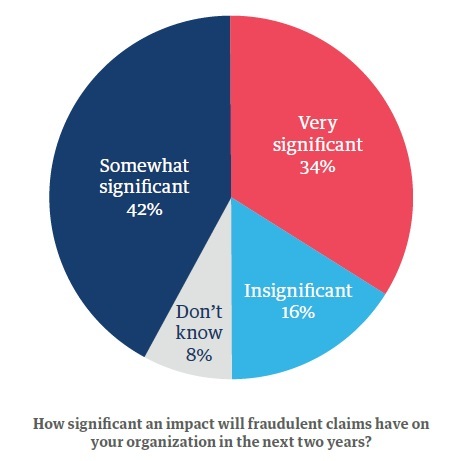

Although most insurers have embraced new technologies to detect and prevent fraud, it’s still an endemic problem. Over three quarters of our respondents say fraud will have a significant impact on their business over the next two years.

But there is light at the end of the tunnel. Sixteen percent tell us they can now control claims fraud to the point of insignificance, meaning they can be more competitive on price and focus on servicing profitable customers (figure 3).

How significant an impact will fraudulent claims have on your organization in the next two years?

Putting the AI into claims

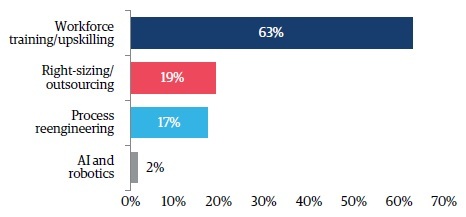

There’s a massive AI opportunity being missed when it comes to managing expenses, with only 2% of respondents saying they use AI and robotics (figure 4) as the main way to keep costs down.

Whether it’s used to automate the claims process, detect fraud early, or calculate more accurate settlements, we expect to see AI adoption grow quickly in the coming years as the technology becomes more accessible, and the scale of potential savings becomes too big to ignore.

Sixty-three percent of our audience say they use training and upskilling as the main tool to manage expenses. And it’s true, training staff to be more effective and cost conscious can have a big impact on the bottom line, but only if it’s part of plan of continuous improvement and not a one-off program (figure 4).

What is the primary method your claims organization uses to manage expenses?

Time to ditch the legacy shackles

When we asked about priorities for the next two years, nearly half of respondents say they want to improve customer retention through better customer service, while 37% see reducing expenses as the main goal.

When we delved into what will help them achieve these priorities, improving agility comes out top, followed by creating a seamless customer experience, and then digitizing the claims process.

These results reflect the wider industry problem of expensive legacy IT systems that make it difficult to integrate new technology, and leaves customers frustrated. Increased agility will improve customer satisfaction, but overcoming the problems thrown up by legacy systems can be daunting. But it needn’t be. A lot of the insurance-specific innovations have been designed with this problem in mind and can interface with existing IT.

Where to invest?

Insurers that have invested in new technologies to transform claims are rewarded with more efficient processes, happier customers, reduced fraud, and better decision-making.

With customers pressing for change and insurtech challengers multiplying, there is a big opportunity to increase the adoption of new technologies in claims. The problem can be knowing where to start.

Claims leaders must understand which technologies can help with their specific challenges, and how they will impact the key metrics of customer satisfaction, managing expenses, and controlling losses to build a strong business case.

Large-scale investment is not cheap, but as our survey results show, the pay-off is there for those who take the plunge.