- Article

Leap on new F&A priorities and expectations

Cardinal Health shows how finance is becoming more customer focused, predictive, and strategic

HFS Research analysts recently conducted a webinar with senior executives from Genpact and Cardinal Health to explore how finance organizations are reinventing their functions. As leadership teams expect finance to drive transformation across the wider business, CFOs must rethink the talent, skill sets, partnerships, culture, methodologies, and technologies at play.

CX and analytics are top among finance's new priorities

With advances in technology and changing competitive environments, many businesses have new, higher expectations from their finance functions. Chief among them is the need to enhance the user and customer experience and generate actionable insights.

Becoming a strategic partner means CFOs must enable their teams with data-driven approaches that deliver more accurate, predictive insights and support enterprise-wide decision-making. The finance function also needs to make better connections across the organization, including supply chain and customer operations, and externally across the larger ecosystem of partners.

At HFS, we refer to these capabilities as the critical success factors that will get us to the promised land of 'invisible finance,' in which accounting transactions run like water and finance professionals focus on driving strategic objectives. Invisible finance will deliver continuous accounting, effortless payables and receivables with near-zero cycle time, and real-time analytics that enable predictive decisions.

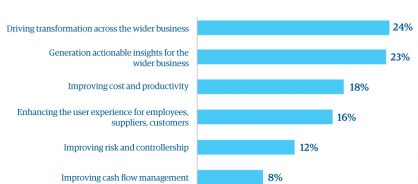

To get to invisible finance, CFOs will require tremendous coordination across the organization and will need to build a wide-ranging set of new capabilities and methodologies. Our poll uncovered the biggest expectations for finance among attendees in the next two years. The results echoed our observations: enterprises expect finance to drive transformation across the wider business (see Figure 1).

Figure 1: HFS webinar poll shows business leaders expect finance to drive wide transformation

Amaresh Tripathy, Analytics Business Leader at Genpact, concurred with the poll finding, stating, "We see four themes coming out of our discussions with finance leaders, and F&A leading the digital transformation agenda is a big theme." He also outlined the role of finance as a connector, digital transformation leader, insight generator, and new talent nurturer (see Figure 2).

Figure 2: Four emerging roles for finance

With the help of Genpact, Cardinal Health is focusing on finance's role as an insight generator

Eric Johnson, VP of Channel Finance at Cardinal Health, shared his organization's journey to evolve the role of finance. Cardinal Health's analysis identified that it had an unsustainable cost structure due to complexities in its processes and systems. It had also not fully integrated many of its acquisitions into Cardinal Health's financial processes or invested substantially in tools and capabilities within the finance function.

The healthcare market was changing quickly, and the business had increasing demands for new insights from the finance team. But the percentage of manual rework and data manipulation Cardinal Health's finance organization had to perform impacted its ability to deliver. Eric's group wanted to free up the team's time to perform more forward-looking analytics, but complex nonstandard processes overburdened them, and they didn't have the tools to execute this effectively.

As Eric said, "We identified our guidelines as transform, optimize, and innovate, allowing us to leapfrog from our current state. This put an emphasis on speed, end-to-end ownership, and a partnership that we believed would keep us on the cutting edge of capabilities now and into the future." It was critical that Cardinal Health created a forum for senior finance leadership to stay fully engaged. The company used Genpact and other outside experts to help drive this alignment, focusing on change management and honest communication.

Cardinal Health's day-one focus was on removing internal complexities by taking a fresh view of its operations and how partnerships could challenge its thinking and provide digital capabilities. Commenting on new approaches to talent, Eric said, "One of the more complex situations we had is 'co-mingled' finance roles. This would include finance employees that are executing financial planning and analysis, order-to-cash, and record-to-report activities. By standardizing these core processes across the segments and businesses, we could centralize and then automate this activity while freeing up our employees' time for more business partnering."

Following these priorities, Cardinal Health has established an automation, analytics, and artificial intelligence (AAA) hub in Columbus, Ohio, for its FPA work and certain analytics capabilities. By transferring many of its FP&A employees to Genpact, Cardinal Health's former employees partnered with data scientists and analytics experts to better utilize AAA capabilities and drive process improvements.

This partnership creates a powerful, mutually beneficial finance and analytics center while minimizing business disruption. As Eric said, "We are early in the journey, but we are very pleased with the initial results… our former employees have embraced the vision and their new employer. They are also energized by 'the art of the possible' and the commitment from both companies to our future success."

The bottom line: finance has a larger role to play with digital transformation

One of the key takeaways was that finance needs to take a leadership role in the organization for certain transformation efforts, such as becoming the custodian of data. Amaresh pointed out the gap between business and IT today: "I see large data programs becoming tech-led efforts in many organizations, and they don't always end well. It is finance's responsibility to become the enterprise's data custodians.

"The reason why this is not happening as fast as it should is because of the talent gap. I recently saw a large industrial conglomerate client, where the CDO [chief data officer] actually became its new FP&A lead. This is a sign of the times to come."

As expectations change for what a finance organization must deliver to its business partners, so must the talent, skill sets, and culture around co-owning technology programs with IT to drive success.

This article first appeared in HFS research.