- Point of view

Smarter originations mean smarter, and faster, credit decisions

For lenders and borrowers, the time is right for change

Which of the following costs less and is faster: to originate a commercial loan or to manufacture a car? Right now, the smart money would be on the car. But perhaps not for much longer.

Recent studies have shown that a commercial loan agreement for $5–$10 million can take more than 30 days from application to close and cost approximately $14,370.1 Meanwhile, a Mini Cooper can take less than 30 days to be manufactured, with a cost of around $14,764.2

Clearly, banks and financial institutions want to grow their commercial lending businesses, and their customers want faster credit decisions. So it’s little wonder that both feel an urgent need for a better, smarter way of processing loans.

Increased competition is driving change

Like any business, growth is the ultimate objective for commercial lenders and their shareholders, but the market offers little comfort. The competition is becoming more intense, both from other banks and from financial technology companies. As demand softens and banks view commercial credit as a safer asset class, gaining market share from these competitors is the only way to achieve growth.

Commercial lenders must focus on differentiating how they engage with their customers. By improving the customer experience, commercial lenders can find better ways to deliver what customers want: namely, faster decisions on their loan applications, even if the decision isn’t what they were hoping for.

As borrowers in a highly relationship-based business, customers are also more likely to apply in person and want a strong connection with their relationship manager (RM) at the bank. In addition, commercial borrowers have higher expectations as consumers based on their experiences in everyday life, where they are used to fast, efficient turnaround when, for example, purchasing airline tickets online or buying an HDTV on Amazon. In short, borrowers want a better customer experience, whether human or digital.

A broken process

From the bank’s perspective, the loan origination process needs to be fixed. Both the time to decision and the time to close a commercial loan are too long and uncertain. Credit processes are inefficient and attrition rates are high, with many customers dropping out of the origination process altogether.

When the customer stays the distance, however, the larger the ticket, the more important the role of the RM. But RMs are forced to spend too much time on non-revenue generating activities, such as credit analysis or portfolio monitoring. While these may be significant aspects of their roles, they are also non-core activities.

Banks must help RMs be more efficient, reallocate their time, and make it more productive – because this is time that could be better spent working with customers or prospecting for new clients. Most commercial lenders relate to these challenges and agree that there is a major opportunity to gain new customers by making their commercial lending originations processes more effective. The smart ones recognize that using digital solutions is the way to do so.

Figure 1: An equation for growth

To increase the volume of originations they close, commercial lenders are following a specific formula, which they can underpin with digital tools: inflow + velocity + scale + vigilance = increased originations. Each of these elements is vital to improving the loan origination process:

- Inflow: increase pipeline by enabling RMs to spend more time on prospecting

- Velocity: shorten the time to close through faster execution

- Scale: reduce FTEs and cost per loan originated via greater capacity to handle increased pipeline

- Vigilance: reduce the time it takes to discover risks by identifying and responding faster to adverse credit events With the opportunity to increase growth in mind, commercial lenders can adopt digital solutions across the spectrum of the loan origination process and create a seamless customer experience

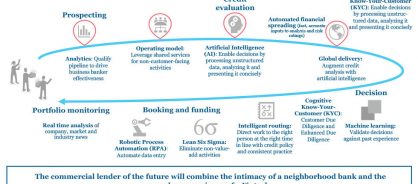

Figure 2: What smarter originations would look like

In the prospecting phase, advanced analytics and artificial intelligence (AI) can be used to quantify the extent to which a prospect is inclined to take a commercial loan. This helps lenders qualify their pipeline, so that their RMs are not chasing the proverbial needle in a haystack. An optimal operating model allows RMs to leverage shared services for non-customer-facing activities.

For credit evaluation, AI that processes unstructured data, analyzes it, and presents it concisely enables lenders to make critical decisions. Automated financial spreading provides fast, accurate inputs to analysis and risk ratings. Front-office underwriters are supported by a global team of credit analysts, who perform support tasks that have not been automated.

In the decision stage, machine learning can help validate decisions against past experience. Intelligent routing can direct work to the right person at the right time in line with credit policies and practices. Post-decision due diligence can be accelerated by using AI and machine learning in the know-your-customer process, and by leveraging computer vision as well as augmented reality for real-estate due diligence.

For booking and funding, Lean Six Sigma processes eliminate non-value-add activities, while robotic process automation can help automate data entry. Finally, for portfolio monitoring, AI-enabled analysis allows lenders to analyze relevant company, market, and industry information in real time.

Figure 3: The 5 big shifts being made by commercial lenders

Lenders are already achieving significant results by making five key shifts in their approaches.

- Historically, lenders created new industry verticals as a way to differentiate themselves – but the problem is that having multiple industry-specific underwriting teams can result in capacity constraints. So, while lenders are still specializing in specific verticals, they are now rearranging underwriting and middle-office functions to cut across verticals, while still maintaining specialization for front-office activities.

- On the consumer front, a shift took place some time ago from push to pull marketing – that is, from promoting products by pushing them onto customers to pulling customers in by establishing a loyal following. Similarly, in commercial terms, lenders are now using AI to measure statistics, such as propensity to borrow, churn risk, and cross-sell opportunities, to draw in new customers.

- Lenders are realizing that human decision-making will always be involved in the process, particularly for loans above $1 million. As a result, they are moving away from the obsession with automatic approval towards analytics-based early filtering, so that slower-moving traffic does not hold up faster-moving deals.

- Lenders have moved from credit committees to digitized workflow approvals, but legacy workflow systems cannot keep pace with evolving credit policies. However, as implementing a modern loan origination system is expensive and time-consuming, lenders are digitizing tasks rather than automating workflows.

Until recently, for example, lenders tracked when financials were due via workflow triggers and on due dates underwriters entered the key covenant calculations into the workflow system to satisfy those triggers. Now, lenders are automating financial statement spreading, calculation of ratios, and comparison with covenant compliance certificates submitted by borrowers.

- Instead of asking how they can process activities with fewer resources, lenders are asking whether they need to perform those activities at all. For example, does the due diligence required for a $1 million loan have to be the same as for a $50 million loan? Is the laundry list of covenants adding any value?

By applying digital and data solutions to the loan origination process, commercial lenders can achieve several measurement goals. These include:

- Accelerating time to close by 50% by leveraging operating model design, process improvement, and digital tools

- Increasing the time RMs spend on selling by a factor of two by reassigning tasks to a middle office

- Improving sales effectiveness by giving RMs the information and analytics they need for effective targeting to improve conversion rates

- Enabling faster detection of credit quality issues by giving underwriters the analytics required to identify early warning signals

- Lowering cost to serve

- Transforming customer experience and satisfaction by implementing a seamlessly integrated solution

Visit our banking and capital markets industry page

Commercial lenders who want to stay head of their competition must aim to change the way they do business. Implementing digital technology, simplifying their processes, and redesigning their operating models can not only help them transform customer experiences, but also drive growth, mitigate risk, and improve efficiency.

Today’s borrowers are at ease in the digital world – and they have high expectations as a result. The sooner lenders respond to this reality with digital and analytics as part of their solutions, the sooner the smart money will no longer be on manufacturing a Mini, but on commercial loan origination as the faster and less expensive process.

1. Precision Lender, The Kafafian Group; Genpact experience based on C&I and agricultural loans of average complexity; excludes overhead cost allocations.

2. Oliver Wyman, BMW Mini, Genpact research