- Point of view

Adapting accounts payable to keep the business running

How to rethink accounts payable to strengthen your cash position and build resilience

As the world responds to the ongoing impact of COVID-19, enterprises are quickly reorganizing their accounts payable (AP) functions to maintain supplier continuity and cash flow.

Organizations in heavily affected areas will have felt the impact acutely. Those dealing with global suppliers and just-in-time delivery models are likely to have been unprepared for this level of supply chain disruption.

AP teams play an important role in supporting their businesses at this time by managing an efficient and effective approach to supplier payments that doesn't affect essential business supplies or the business' reputation. To build a more robust, forward-looking AP function, we've identified three key stages your business should follow: agility, cost, and resilience.

But before that, let's look at the challenges facing AP and, in some cases, procurement, and how some companies have overcome them. We examine the issues from an operational perspective (receiving and processing invoices) and a strategic point of view (managing cash and supplier relationships).

Receiving invoices

AP teams must manage disruption to the receipt of invoices, including fluctuations in invoice volumes and a high number of suppliers requesting timely or early payments. Some document-management providers have had to stall operations in affected countries, which has delayed scanning and the receipt of invoices. And, where organizations have been reluctant to allow employees to work from home, AP teams have not had access to invoice work queues, which has delayed payments to suppliers.

Organizations with a high level of e-invoicing penetration and straight-through processing are well placed to keep the AP function going. Companies that still rely heavily on paper invoices and people for manual processing are more likely to experience greater disruption.

Take a copy for yourself

Processing invoices

When teams are unable to prioritize critical tasks and activities, they upset operations. Teams must process and pay invoices for critical suppliers, such as utilities, housekeeping, janitorial services for disinfecting premises, and contingent procurement staffing, which would focus on the availability of essential supplies such as gloves, safety equipment, and masks. The business-continuity plan must factor in these activities.

Organizations that have mature upstream operations such as higher catalog penetration or on-time receipts and have invoice auto-post features configured in their ERPs will achieve touchless invoice processing, enabling payment on time.

Digital technologies

The repercussions from COVID-19 have triggered delays in coding or approving invoices, for example. Buyers deviating from policies to expedite purchases also increase costs. And when postal and courier services shut down, they render paper invoices obsolete, which means invoices aren't recorded in companies' systems, and cash forecasts are incorrect.

Organizations that have installed point solutions like machine learning for non-PO invoice coding or workflows for e-mail invoice ingestion with intelligent optical character recognition (OCR), or have integrated Amazon Business into internal procurement processes will experience fewer problems.

Cash resilience

Organizations are working to strengthen their cash positions so that they are more resilient to market fluctuations. Some enterprises will delay payments, for example, by doing only one payment run a month or dismissing eligible discounts for extended net pay days. But delaying payments for suppliers will harm your business' reputation.

Organizations that have extended payment terms for suppliers and use innovative financing solutions to allow early payments with discounts will have greater flexibility to meet their cash requirements without denting their reputation.

Supplier relationships

Times like these will test enterprise-supplier relationships. Price revisions and fluctuations for key commodities could increase invoice exceptions and delay payments. Many companies will turn to alternate or one-time suppliers. The need for quick onboarding could compromise compliance checks relating to financial health or outlook and safeguards against fraud.

Organizations with strong supplier-management solutions that include third-party-risk management, sustainable procurement, and self-service solutions that allow suppliers to view the status of their invoices and resolve exceptions, will fare better.

Figure 1 shows how the impact of Coronavirus is being felt on the procure-to-pay (P2P) function in different industries.

Figure 1: Impact of COVID-19 on P2P across sectors

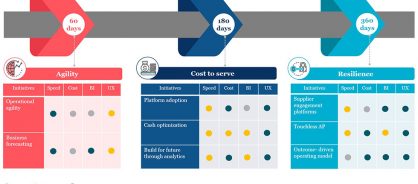

With these challenges, organizations need to rethink their AP functions' objectives and priorities to sustain growth in the long run and stay operational in the short term. To address current disruption, action plans should begin now. And we believe a staged approach with focused initiatives will help companies build greater resilience. Figure 2 summarizes how P2P organizations are reprioritizing initiatives:

Figure 2: Three priorities and phases for P2P

- Agility (0-60 days): The immediate need for P2P organizations is to respond to current challenges with agility. Adopting e-invoicing models to drive upfront digitization and optimizing payment calendars to support internal working-capital arrangements will build stability. Addressing the needs of the supplier community will be critical, so consider using effective help-desk response techniques to enhance supplier engagement.

- Cost to serve (60-180 days): Because of travel bans and the need for social distancing, it's the right time for companies to make the most of their existing e-invoicing and supply chain financing solutions. With advanced analytics solutions, companies should model their financials (cash flow, profit and loss, and balance sheet) in each scenario and identify triggers that might significantly impair liquidity; for example, using flexible financing models available through fintech solutions.

- Resilience (180-360 days): An outcome-based operating model with business analytics at its core will help your business withstand future periods of uncertainty. Digitally powered operations that drive touchless payables, and a collaborative and responsive supplier ecosystem will also help develop resilience to disruptions.

Looking ahead

As organizations continue to focus on keeping their employees safe and their businesses running, there are still invoices to process, bills to pay, supplier inquiries to respond to and expenses to reimburse.

Businesses are reprioritizing their strategic objectives and adjusting annual plans to ensure that the most critical functions (such as accounts payable) carry on as usual, and that there's room to grow when recovery begins. We believe that AP teams play a critical role and should focus on three stages – agility, cost to serve, and resilience.

With a streamlined P2P function, organizations can improve cash flow, achieve greater transparency and control, boost compliance with more consistent data, and deliver payment strategies that support both their businesses and the ecosystems of suppliers.

Learn more about how Genpact can help accounts payable.

This point of view is authored by Zaheer Abbas, AP Service Line Leader; Srinath Vijayan, AVP, AP Service Line; and Sneha Misra, AVP, AP Service Line at Genpact.