- Case study

75% efficiency gains in performance reporting dazzle a top wealth manager

Who we worked with

A global wealth management firm

What the company needed

When the firm got data from outside custodians, it came in a variety of formats. This made it hard and slow going to compile reports for a big picture view of a client’s finances. And, without standardized technology and processes, its financial advisors (FAs) created their own manual ways of doing things, leading to errors in billing and reporting.

How we helped

Using Genpact Cora and all the artificial intelligence (AI) it delivers, we delivered Genpact’s Cora LiveWealth product for our client. Now, the firm can rapidly pull, collect, and organize data from different custodians and formats. This makes it quick and easy for financial advisors to monitor assets in real time and create on-demand reports. With a centralized system in place, the firm has standardized processes for better compliance and fewer errors.

What the company got

The firm has boosted efficiency by 75% and reduced its quarterly reporting cycle from 45 days after quarter end to just five days. Needless to say, this faster turnaround vastly improved customer satisfaction, too. Clients now get a holistic view of their portfolios—including outside assets—on demand. And managers can access enterprise, financial advisor (FA) and client transactions daily to gain a broader perspective on overall activities.

A global wealth management firm’s fragmented technology and processes made reporting and analytics difficult. Genpact’s AI and machine learning tools addressed these challenges and transformed data management to improve efficiency and overall growth.

Challenge

Lots of data formats and fragmented operations

The firm’s process for gathering data, producing reports, and conducting analysis had become a big problem in the eyes of both its financial advisors and clients. Many of its clients hold assets, especially alternative assets, with multiple custodians that deliver data in a variety of formats, including Excel spreadsheets, PDFs, images, faxes, and paper documents. All these different formats resulted in a lot of unstructured data that took a long time to process and analyze.

Without the right technology to work with, advisors ended up creating their own manual ways of doing things. To make matters worse, the firm had outsourced several steps to outside partners. There were four parties (two external partners, an internal analyst team and the advisors) all trying to work together on the same process, but in a very fragmented way. All this, led to slow, error-prone reporting to customers. It often caused inaccurate billing, too.

The firm realized this wasn’t going to work anymore – it needed to streamline and automate.

Solution

A single, seamless platform backed by powerful AI

We introduced a single platform to deliver information in a sustainable manner to all stakeholders. Once we addressed that major hurdle, we used the same platform to tailor services and analytics for every relevant party—eliminating most of the challenges the firm faced.

We implemented Genpact Cora LiveWealth product to improve overall efficiency in just 90 days—a quick turnaround, thanks to Genpact Cora’s robust machine learning and AI capabilities. Cora LiveWealth uses AI, including data extraction technology and machine learning, to rapidly automate the gathering, extracting and normalizing of data on assets held away—

streamlining everything from sourcing to reporting.

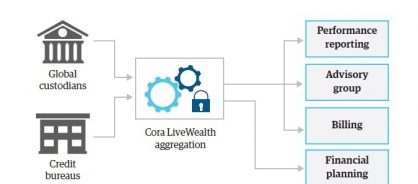

Figure 1: A schematic of the automated aggregation product developed on the Genpact Cora platform

At the same time, Cora LiveWealth went to work delivering on-demand performance reporting and enterprise dashboards across business lines. Our product also aggregates consumer bureau information, highlights liabilities, builds balance sheets, and creates flexible asset classification schemas. Management, FAs, and customers now all receive personalized reports, on demand.

Impact

Better financial decision making in real time

Improving operational efficiency by 75% was certainly uplifting. But the real satisfaction came in knowing this firm was surprising and pleasing all its stakeholders with information they needed in real time to make better, more nuanced financial decisions. With Cora LiveWealth, the firm gained a real-time, big picture view into clients’ internal and external assets held away, and created real competitive advantage for their firm.