- Solution overview

Continuous Close Accelerator

A cloud-based framework to make your on-demand financial close vision a reality

For many people on the front lines of accounting, the challenges of traditional closing processes are all too well known. They include:

- Costly upstaffing and overtime to meet critical deadlines, resulting in skewed workloads, rework, and frustrated team members

- Poor coordination between departments that possess information vital to the closing process

- Reporting after close and a decision-making process plagued by manual effort, data issues, and adjustments

- Error-prone manual transactions and entries that take up most of the finance team's time, leaving them with little time to meet business partnering expectations

- Dated threshold and cutoff policies that don't reflect new business realities

- Little visibility into closing activity timelines, making overall management of the process difficult

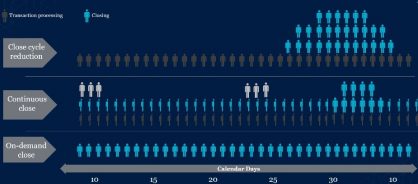

Cutting-edge finance teams are addressing these issues by ushering in a paradigm shift in the month-end close process. They are embracing new digital technologies, ways of working, and culture to transform the linear financial close process to a hyperloop that enables continuous financial close (figure 1).

Figure 1: The financial close journey

From linear to circular

Genpact can help you achieve that ideal. Our Continuous Close Accelerator lets you transform closing from a stressful, linear, resource-devouring exercise to an ongoing, dynamic process that delivers rich business insights.

The Continuous Close Accelerator is an intellectual property created out of our years of rich experience in finance and accounting. It's a cloud-based diagnostic framework built on our deep-rooted understanding of how the pressures of closing vary from industry to industry. We know that geography, business segments, and a company's existing technology also impact the process, so we're well equipped to evaluate every unique aspect of your circumstances. We lay the groundwork for the kind of on-demand reporting that provides real-time intelligence to sharpen your company's competitive edge.

Our streamlined, modular approach encompasses automation, resequencing of steps, process simplification, user experience, and control – all of which can ultimately lead to continuous close of books. First, we assess the efforts, activities, and resources that your current closing process demands. Next, to make these more efficient, we recommend a range of process and technology solutions based on your firm's goals and appetite for change. We also build first-step scenarios that reveal places where you can realize immediate benefits, which will prepare you for the ultimate transformation to an on-demand close.

Take a copy for yourself

A diagnostic framework you can build on with confidence

Here's how it plays out in practice:

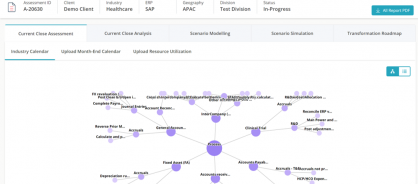

- Our neural network offers nuanced, industry-specific close calendars to transform your close process. This is based on our experience of executing virtual closes for more than 100 global companies across several industries, working with experts from an array of business transformation areas. We further customize the calendars based on ERP, geography, and business segments. This customization is carried out by a machine learning engine that constantly updates industry- and ERP-specific continuous close neural networks with details like what kind of automation will be most suitable, frequency of transactions, and flow of data

Figure 2: Industry-specific standard close calendars

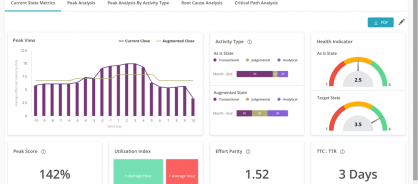

- The built-in framework delivers an automated evaluation of your current close practices and benchmarks them against industry standards of plausible continuous close. It enables evaluation of your current close effort across parameters such as effort by activity type, workday, resource, and sub-process. Additionally, it offers metrics reflecting true month-end close chaos and its contribution to reporting delays. It also allows for a critical-path analysis for minimizing slack, which can formulate corrective action

Figure 3: Current close cycle visibility and benchmarking

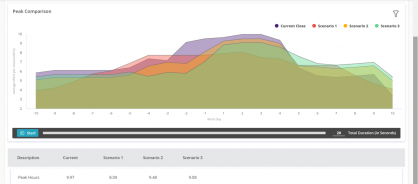

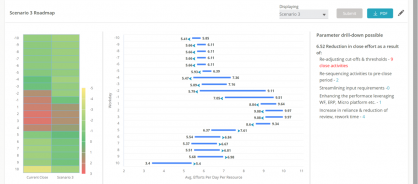

- Multidimensional simulation scenarios use powerful algorithms that reimagine the future state of your finance processes to offer customized roadmaps. The framework recommends a solution for every task, along with real-time quantification of the impact on close timeline and effort. You can modify our suggested corrective actions and recommendations based on your firm's goals and appetite for change, measuring and quantifying the value of these changes as you go

Figure 4: Scenario analysis for efficiency and speed impact

- We build a window that reveals your continuous close future. When you select a scenario, the system automatically generates a roadmap with a detailed view of how transformation will flatten the typical peak that occurs during the closing period. It also reveals places where you can regulate the time and effort needed for monthly and quarterly close activities

Figure 5: Future close cycle visibility and transformation roadmap

The outcome: A stress-free financial close process that delivers constant insights

Our Continuous Close Accelerator delivers on its promise. Clients are taking advantage of its embedded industry knowledge and end-to-end analytics to generate actionable insights. The scenario feature provides them with the information they need to move forward in transforming their close processes. They see far more efficient use of their resources, with the potential for as much as a 60% reduction in deviations between work throughout the month and at peak closing periods. In addition, solutions we've introduced have moderated specific peak load efforts and activities by as much as 40%. They've also singled out our customized transformation roadmap as a valuable asset that can help reduce overall time to close books by more than 20% and accelerate their journey to true on-demand financial close.