- Solution overview

Actuarial services for life and annuity insurers

The challenge: Competitive and regulatory pressures piling up for actuaries

Changing customer behaviors and preferences and the rise of insurtechs are increasing competitive pressure on actuaries. They need to offer the right products at the right price and speed up underwriting processes.

On top of this, new regulations such as LDTI, which impacts actuarial modeling, and IFRS 17, which comes into play in 2023, are adding to the challenges actuaries face.

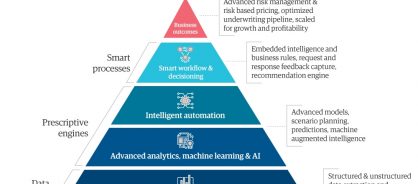

These developments are happening at a time when actuaries need to tap into more data than ever before. Machine learning (ML) and artificial intelligence (AI), along with the insights they generate, are parsing statistics in important new ways.

All these factors are putting pressure on insurers and their actuarial teams to streamline their systems and processes and adopt a new digital framework.

But modernizing the actuarial function is no easy task. Actuaries spend up to 80% of their time consolidating and cleaning data, preventing them from focusing on core actuarial responsibilities. And the recent series of mergers and acquisitions within insurance has left many firms with fragmented, disparate, and siloed data environments that they can't mine for valuable insights. This also limits actuaries' ability to do what they do best: innovate.

What's more, companies may find it difficult to allocate resources to hardware upgrades and other capital-intensive spend in an uncertain economic climate as well as amid rising compliance costs.

The solution: A strategic partner to ease the actuarial workload

The key to prevailing in the current competitive climate is to work with a trusted partner who can support everything that actuaries do – from inputs and modeling to outputs and deliverables.

Genpact can be this partner. Independent analysts have recognized us as a leader for the consulting services and solutions we provide to the insurance industry. Our team has extensive experience and our bench strength is deep. Our actuarial specialists all hold advanced degrees in statistics, econometrics, mathematics, data science, business management, and other related specializations. Plus, we're committed to their development, sponsoring the Society of Actuaries and other professional organizations.

And we're constantly replenishing our talent pool. We have a human resources team dedicated to finding and nurturing the best in the field. And when recruits are on board, our award and recognition programs bring out the best in them. These innovative people practices mean that our actuarial employees remain engaged and loyal to our company and our attrition rate stays low.

Take a copy for yourself

Their hands-on experience means they know actuarial and statistical modeling platforms inside out, including MG-ALFA, TAS-MoSes, GG-Axis, RMS, Open Xposure, and MATLAB, and they're well-versed in Python and SQL programming languages.

Our life and annuity practice

Our global life and annuity (L&A) practice covers every facet of L&A insurance. This includes term life, whole life, universal life (with and without secondary guarantees), variable universal life, long-term care, fixed and variable deferred/immediate annuities, and retirement services and investment management support. It also covers long-term care, fixed and deferred annuities, retirement services, and investment management support.

We're well versed in dealing with changing regulations and are accelerating our clients' ability to meet the latest compliance requirements for both LDTI and IFRS 17.

We're also helping L&A insurers refine their actuarial models, creating data warehouses for seamless reporting and then updating finance reporting as a result of these changes. What's more, we're making it easy to adapt to all these changes with accessible data visualization dashboards and program management support.

Here's the full range of what we offer L&A insurers:

Pricing and product development

- In-force action/rate filing services

- Pricing model development

- Profitability reviews

- Product documentation

- Sensitivity analysis

Valuation

- Projection and valuation modeling support and maintenance

- Data reconciliation

- Reserving documentation and reporting

- Asset modeling for ALM

Predictive modeling and experience studies

- Predictive modeling using GLM models

- Risk differentiation and data imputation

- Data and technical services for predictive modeling using artificial intelligence and machine learning

Modeling

- Model coding for new products and for in-force changes

- Model modernization

- Model maintenance

- Testing guidelines

- Model result consolidation

Investment risk and capital management

- Distribution analyses of risks

- Economic capital modeling

- Credit VaR analyses

- Interest rate analyses

The impact: Actuaries freed to innovate and add value

When actuaries don't have to worry about data preparation and business-as-usual activities, they're freed up to focus on more critical, high-value work.

Our work with L&A insurers delivers:

- Significant reductions in run times that cut your actuarial team's operating costs

- Optimized processes driven by digital solutions and analytics

- Improved model outcomes in lapse and mortality projections and predictions

- Flexibility and greater control in assumption setting

- Simplicity in generating customized reports

- Continuous support from our experts

- Ongoing and strong relationships with all our consultants that support governance to move your business goals forward

- Thought leadership and best-practices sharing that add value to the actuarial enterprise

Visit our life and annuity page

With the L&A industry quickly evolving, the focus is on actuarial transformation. The right partner can help you analyze your team structure, revamp your operating model, and help you make the most of technology and data.