- Point of view

When in China: Best practices for T&E compliance audits in China

Why digitization is key to mitigating travel and entertainment compliance risks in China

China is a bundle of contradictions. Though its vibrant consumer market and culture of innovation make it a preferred destination for investors and businesses alike, it also comes with its own set of unique challenges.

One such area filled with challenges and opportunities is regulatory risk and compliance – specifically, the fraud and corruption risks linked to travel and entertainment expenses (T&E). A common cause of budget leakage, T&E is also often used to channel illegal bribes and kickbacks to customers and government officials.

At a time when regulatory scrutiny has increased around the world – Foreign Corrupt Practices Act (FCPA) sanctions nearly doubled in 2020, for instance – it’s imperative to have robust practices in place to monitor travel and spend patterns, analyze red flags, and take corrective action in time.

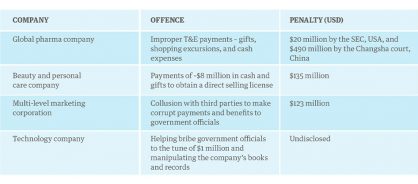

Chinese anti-bribery and anti-corruption (ABAC) regulations have also tightened in recent years – prominent ABAC legislations include the Criminal Law of the People’s Republic of China (PRC) and the Anti-Unfair Competition Law. As a result, several companies have faced regulatory actions for violating Chinese ABAC laws, which have resulted in penalties, reputational damage, and business disruption. Some companies have also faced parallel investigations under the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act (UKBA). See Table 1 for recent prominent cases against global companies.

Table 1: Prominent cases against global companies

A different T&E landscape

Enterprises that operate in China must take into account its distinct culture, business processes, and regulatory requirements when designing their T&E compliance program. Here are some ways in which the T&E environment is different in China:

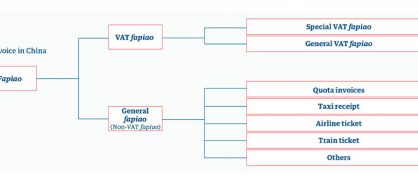

1. The use of fapiao: In China, a simple invoice receipt is not sufficient to record a purchase in a company’s accounting books. Only official tax invoices called fapiao are accepted (see Figure 1 for the different types of fapiaos). This requires companies to follow a defined process for reviewing different kinds of invoices such as quota invoices, fixed amount invoices, and so on.

Fapiao are used by:

- Individuals to reimburse business expenses

- Companies for accounting and tax deductions

- The government to track transactions and prevent tax evasion

Despite the safeguards in place to prevent fraud, fapiao are commonly misused by submitting fake, inflated, or substitute fapiao. And failure to curb such misuse can result in significant civil and criminal penalties for companies. Fraud pertaining to fapiao forgery, nonpermitted amendments, or transfer of invoices can attract a penalty of up to RMB 500,000 (about $77,000).

2. The popularity of cash payments: Though many organizations in China are now promoting the use of corporate cards, cash or mobile payment products remain the predominant mode of payment. According to CGAP, payments through Alipay and WeChat – the dominant mobile payment products in China – constitute almost 90% of the payments in the country. Cash and mobile payments are high risk in comparison to cards because merchant names cannot be validated and payments cannot be automatically linked to expense management systems. This in turn forces organizations to continue to use manual expense submission processes.

Figure 1: Types of Chinese invoices (fapiaos)

Graphic adapted from China Briefing.

3. Manual audits of hard-copy invoices: In China, organizations continue to rely on manual audits of hardcopy invoices submitted by employees, resulting in huge costs toward audit effort, maintenance of documents, filing, and binding (issuers of Special VAT fapiao must retain the hard-copy invoices for a period of 30 years).

Also, it prevents organizations from focusing on higher risk areas for fraud and corruption such as duplicate expenses, fake fapiao, transactions with government organizations and agents, and gifts to government officials and third parties.

4. Language and cultural nuances: Business documentation and correspondence in China is mostly done in Mandarin. But global companies typically fail to localize their existing technology to manage T&E compliance and end up having to rely on manual processes.

Take a copy for yourself

Customizing T&E for China

Genpact believes that to build a robust T&E compliance program in China, you must account for the country's distinctive compliance and business challenges. To effectively manage the risks and challenges highlighted above, you must take the following steps:

1. Review current processes and policies: You should clearly define end-to-end controls for the T&E expense submission and review process. While doing so, you must consider local nuances and yet stay true to your organization's ethical standards. You can do this by developing a China-specific policy addendum that is consistent with your global T&E policy. This should include adequate controls and approval requirements and thresholds, as well as a shift toward digital.

2. Promote the use of expense management systems: Train employees to use a digital expense management system for submitting expenses. Built-in automated controls in this system should define mandatory details to submit across different expense types and require soft copies of fapiao, invoices, and other supporting documents for all expense items.

3. Deploy digital technology: The high volume of transactions at global companies makes it nearly impossible for them to manage T&E compliance manually. You can enhance risk coverage across fraud and regulatory noncompliance by augmenting manual audits with technology. And save money doing so. This calls for a comprehensive compliance framework with a combination of customized technology, processes, and a trained team. This typically involves:

- Leveraging optical character recognition (OCR), AI, and machine learning technology to perform a 100% expense review before approving expense reports (OCR technology will enable validation of itemized receipts)

- Checking for and flagging duplicate and incorrect invoices

- Flagging any high-risk attendees and third parties

- Keyword searches to identify and flag unallowable and high-risk expenses

- Built-in checks to catch fake fapiao by verifying with the Golden Tax website

4. Leverage domain experts: Identify or recruit team members who have a deep knowledge of global as well as Chinese bribery and corruption regulations. These experts can help conduct in-depth reviews and substantive testing for high-risk expenses identified by digital technology.

5. Conduct post-payment reviews: Though we recommend that digital solutions enable AI-based pre-payment review of 100% of expenses within minutes of submission, this should complement post-payment analytics for comprehensive fraud and regulatory coverage and trend analysis for high-risk expenses such as government expenses, gifts, and repeat offenders.

6. Periodic analytics-based reviews of current and historical expense data: This will help you to:

- Monitor for risks such as incorrect, duplicate, or invalid fapiao by running invoice sequence number checks to identify potential fraud by submitting multiple invoices with similar invoice numbers

- Find unusual behavior or noncompliance trends for repeat offenders

- Flag duplicate and repetitive expenses

7. Enable near-real-time reporting: Customized, intuitive dashboards can give leadership teams end-to-end visibility on key health parameters and bolster compliance behavior.

8. Conduct root-cause analysis of noncompliant transactions: This can help identify key risks and enable enterprises to take corrective measures in the form of policy, process, and system enhancements, improved regulatory coverage, training, and investigative reviews to continually improve compliance health.

Finding the right partner

China’s complex T&E ecosystem need not be a hurdle for enterprises looking to capitalize on the many opportunities the country offers. The right risk and compliance technology partner can help you navigate the landscape successfully by bringing together deep market expertise with digital capabilities to embed visibility and transparency throughout the system.

Authored by Harmeet Kaur, Partner, T&E Audit and Compliance, Genpact

For more insights and solutions for mitigating T&E risks, learn more about our compliance-as-a-service offering.