- Point of view

The virtues of the virtual close

Six enablers to reimagine monthly and quarterly reporting

In late March, when thousands of Genpact's finance employees were suddenly forced to work remotely due to COVID-19, individuals and teams adapted quickly to their new arrangements.

Rapidly approaching the end of the first quarter, they not only closed the books for more than 100 clients remotely, but they also made it happen half a day or two faster for some and on time for all others. This gave the companies' decision makers the critical intelligence they needed to make the right decisions in a rapidly shifting environment.

Based on these experiences, we've compiled actions your company must take to achieve an accurate, timely virtual close and build a more resilient organization.

The virtual close matures

For years, a virtual financial close – a way to close the books regardless of location – was a lofty goal for finance functions. Though few companies had achieved it, the tide had started to turn even before COVID-19 made it an essential capability.

Innovations in technology, alongside increasing reporting demands and controls, made many firms take a second look at the advantages of a virtual close. And then because of Coronavirus, finance organizations had to pivot to embrace this new approach. In fact, during a recent webinar, 70% of participants said that COVID-19 has had a positive impact on their financial close process.

How we prepared for a virtual close

Adopting a virtual close during a crisis with everyone working remotely presented a number of challenges.

To close the books, finance teams go through a set of interdependent micro tasks. How do you ensure they're performed correctly when people are working flexible hours at home? How do you make provisions if you don't have the necessary data for accruals or adjustments on hand? How do you contend with a growing backlog of invoices and suppliers to pay? And how do you gain auditor confidence that your reporting is accurate when your data is decentralized?

We found that process rigor was a major asset and that establishing priorities was key. Here are the six steps we've taken for more than 120 companies.

Take a copy for yourself

Step 1: Plan

Having anticipated that pandemic-related restrictions would come into force in March, we worked with our clients to invoke partial business continuity plans (BCPs) for the February month-end close to train the team for a virtual close.

As part of close planning, we extended the cycle time by one-to-three days and revised the close calendar. We also jointly sketched out the backup plan with clients to identify the fundamental activities they needed to complete, and alternative resources, should the need arise.

To help companies keep finance moving, we designed remote-governance policies using collaboration tools that addressed day-to-day challenges, such as IT issues and backup tasks. We also assessed their technology and data infrastructure and outlined risk-mitigation plans.

Getting critical personnel ready for remote work called for more than simply shipping laptops and monitors to people's homes. Along with creating a digitally enabled virtual world of work, maintaining the company culture and keeping employees motivated were important too.

Step 2: Prioritize close activities

We prioritized activities critical to external reporting and resequenced activities based on how crucial they were. For example, we brought forward journals, reconciliations, and intercompany settlement to create additional bandwidth during critical close cycle times.

Regular cadences for day-to-day activities like processing journals, fixed-asset transactions, or reconciliations helped identify backlogs and any missed tasks so that resources could be realigned to key activities. We tracked daily KPIs, such as requests received versus requests processed, and monitored open items by aging. It was important to get client support for newly transitioned activities or where we needed additional governance and regular touchpoints.

Step 3: Adjust processes and policies

New procedures demand clear policies. We increased the materiality thresholds for journals, performing reconciliations, recording intercompany transactions, and capitalizing fixed assets.

We paused some usual practices and relaxed controls for reconciliations and journal approvals, as well as the turnaround time for exception approvals. And we did away with non-critical events, such as multiple close deadlines, soft close, and non-critical controls. Given that people were working remotely, we used systems of engagement and workflows for seamless reviews and approvals.

We modified policies, too. For example, intercompany discrepancies can delay closure. So, defining dispute thresholds in the current situation helped to keep the challenges from dragging teams down.

Step 4: Check to see if infrastructure is up to speed

We helped clients source extra computers so that the accounting teams could quickly work from home using their own devices or the devices we'd delivered to them. We enhanced their internet bandwidth and provided VPNs, Wi-Fi, and/or dongles when needed. And because many organizations only allow a limited number of logins from remote locations, we had to address latency issues due to extra logins. Finance executives also had 24/7 access to IT support.

Step 5: Keep things moving

We set up daily huddles and leadership reviews to identify – and address – bottlenecks in key tasks and third-party dependencies. These extended to the impact of upstream process challenges as well. They were integral to a successful virtual close.

To get near-real-time visibility into the close process, we updated the governance tool with the revised plans and task assignments.

Step 6: Don't stop collaborating

Without the consistent use of collaboration tools like Microsoft Teams, Skype, and Zoom across Genpact and with our clients, many of these steps would have been nearly impossible. But we set up mandatory training in how to get the best use of these tools, too.

From creating breakout rooms for teams to address clarifications to using SharePoint for co-authoring, these platforms were crucial. They also acted as a repository in the absence of a reconciliation solution or a workflow.

Finally, clear, concise communication and discussion fast-tracked the journey toward accurate, timely closing, consolidation, and reporting.

What will stay, what will go

Now that we've done the virtual close for more than 100 global companies with COVID-19 restrictions, we're looking at the broader picture.

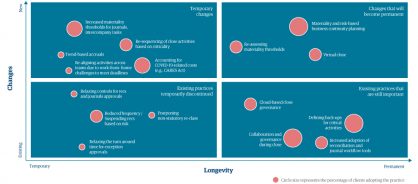

Though some changes were only temporary to manage the disruption, such as resequencing close activities based on their criticality and accounting for COVID-19-related costs such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the US. Some existing practices – like postponing non-statutory reclass entries and relaxing turnaround times for exception approvals – were temporarily discontinued to adapt to the situation.

We believe some practices will become the norm. The virtual close is finally here, and BCP plans based on materiality and risk will also stay. Some initiatives, such as cloud-based governance, increased adoption of reconciliation and journal workflow tools, and backups defined for critical activities, will also remain important (see figure 1).

Building new practices into record to report

Clients have also experienced a significant shift in their transformation plans. Organizations are prioritizing cloud investments, and while ERP upgrades are delayed, systems of engagement are gaining prominence.

When the current level of disruption wanes, new operating models that support remote working, enable new thresholds for reconciliations and intercompany activities, embrace collaboration tools, and maintain robust governance will need to be in place to manage future disruption.

By following these six steps, you can close the books on time with your teams working remotely and build long-term resilience for your business.

This point of view is authored by Vivek Saxena, F&A Service Line Leader, and Garima Kapoor, Subject Matter Expert, Record to Report, Genpact