- Solution overview

Building a strong anti-bribery and anti-corruption program – a holistic approach to a global challenge

When companies expand into new regions, new laws come to bear on their operations – which is why a complete program to mitigate risks is key

Companies are looking for ways to reach customers in every corner of the globe. And as they expand, diversify, and build cross-border engagements, compliance frameworks must keep pace.

The legislative environment demands it. Today, bribery and corruption are behind thespate of laws, such as the US Foreign Corrupt Practices Act (FCPA), UK Bribery Act (UKBA), Sapin II, and other country-specific guidelines. To avoid stiff fines, prison sentences, and brand damage, companies need anti-bribery and anti-corruption (ABAC) programs that reflect local and international laws.

Firms with expanding footprints in emerging markets face increased scrutiny of their day-to-day activities as lawmakers clamp down on bribery and corruption. Staying on top of anti-corruption issues is hard work as is understanding the different laws in countries. For example, a charge that's legitimate in one country, such as a fee to fast track a service, may be illegal in another.

On top of that, there's the pressure to compete, which can induce people to cut corners. Throw in decentralization, unstable operations, unvetted third parties, unfamiliar cultures, and unusual business conditions to the mix, and the risk of corruption increases dramatically.

What's needed? A robust ABAC program.

Comprehensive ABAC compliance programs

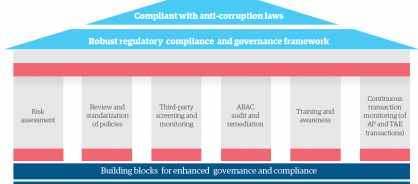

Genpact's ABAC solution illustrated in figure 1, powered by digital technologies and analytics, reimagines your end-to-end risk and compliance practices by using our deep knowledge of regulatory risk and experience in running complex operations.

It embeds multiple digital capabilities, including:

- Language neutralization to translate non-English data to English

- Artificial intelligence to analyze large data sets to identify trends and patterns for predictive analysis

- Machine learning to learn from past runs to improve accuracy

- A robust scoring methodology

- A dynamic workflow

- Advanced analytics and visualization

- Optical character recognition for data extraction from receipts

Take a copy for yourself

Risk assessments

We help you identify business processes that are more vulnerable to corruption and violations than others. With our cloud-based model, you can zero in on the right places to focus your risk monitoring resources.

We use multiple parameters to assess, identify, and profile businesses across all their undertakings. Following are some of the key differentiators of our assessment methodology:

- Integrated risk assessment questionnaire covering all functional areas and customized to the client's terminology; additional questions are included based on specific requirements and questionnaires are updated continually to meet the latest compliance guidelines

- Interviews and discussions to validate responses and not just reliance on responses submitted by the process owners

- Workflow-based review, including questionnaire roll-outs, control gaps identification, and follow up of management action plans across processes and entities

- Actionable insights from the results through visual dashboards for all key stakeholders

Continuous transaction monitoring of travel and expense (T&E) and accounts payable (AP) transactions

Our continuous monitoring solution applies Genpact's CORA analytics to review all T&E and AP transactions using customized and corroborative algorithms to cover fraudulent ones and maintain policy compliance.

The T&E and AP audit review solution uses analytics, dynamic workflow, language neutralization, artificial intelligence, and machine learning to predict employee behavior through Genpact Behavior Science Score (GBSS) built on deep domain experience.

High-risk exceptions review is performed by our experts using smart case management workflow.

This allows you to:

- Do a root cause analysis of exceptions, driving better compliance behavior

- Monitor repeat offenders and track employee spend

- Get near real-time visibility into process gaps and remedial actions via interactive dashboards

Review and standardization of policies

Today, corporate ABAC guidelines must clearly spell out procurement, travel, entertainment, code of conduct, whistleblower, no-retaliation, and accounting policies. Senior management must support and enforce these policies. Our program can help design new policies, review existing policies, identify missing policies and enhancements needed in existing policies, and compare and align local policies with legal and corporate requirements according to industry best practices.

Third-party screening and monitoring

Genpact's third-party risk management (TPRM) solution offers superior third-party screening based on dynamic risk profiles of vendors, distributors, and suppliers. It creates a near real-time risk scorecard of all third parties developed through our TPRM and consulting expertise.

We acquire data from globally accepted databases that include over 1500 sanction lists and 30,000 data sources. We also examine data from open sources to ensure that no alert is missed.

Our solution:

- Generates a report that contains risk rating, alert category, issue summary, and relevant extracts and links of articles for all true hits

- Maintains an audit trail with relevant documentation for all alerts taken for resolution

- Identifies high-risk third parties, then initiates a process for continuous monitoring

Figure 1: Anti-bribery and anti-corruption framework

ABAC audits and remediation

Genpact conducts independent audits, enabled by an automated workflow, which connects the entire process, right from rolling out information and sample requests, to identifying control gaps, and creating, following up and tracking action plans for gaps.

Here are the key features of the audit solution:

- Integrated work program across all functional areas with customizable testing templates

- A standard template for documenting control gaps and root causes, and automated report generation capability

- Complete smart workflow-driven assessment with two levels of sign-off and upload functionality

- Automated reports on potential compliance gaps and remedial measures

Training and awareness

We offer interactive e-learning modules that integrate with existing learning management solutions. Available across multiple devices, these modules help organizations manage, monitor, and report on their compliance programs.

We also conduct internal and external training and awareness campaigns and provide self-assessments and self-declaration tools for effective monitoring. Our dedicated team of SMEs and legal experts keep learning modules up to date.

Our holistic, domain-led and digitally-enabled ABAC program offers the following key features:

- Remote-site delivery

- Advanced analytics

- AI, machine learning, language neutralization, interactive dashboards, OCR, and GBSS

- Policy, regulatory non-compliance, and fraud risk coverage

- Adaptive risk-profiling

- Country and industry-specific audit programs

- Ready to use e-learning modules

- Access to ABAC knowledge through our global panel of advisory experts

- Alerts on regulatory changes through our network of legal partnerships

- Technology partnerships with market leaders

Generating ABAC impact

Robust global compliance programs help companies safeguard against crippling fines, possible criminal prosecution, and reputational damage.

Our end-to-end compliance programs give you greater visibility into your company's third-party vulnerabilities. Our approach strengthens your risk management and compliance procedures so that you can run your global operations with greater peace of mind. And what's more, it saves about a third of your auditors' time spent on administrative work and between 1-1.5% of your annual T&E spend, making it a self-funded solution in five years.

Visit our risk and compliance solutions page

Case study

Who we helped: A global footwear and sports apparel manufacturer

The challenge: Get a handle on suppliers and policies in 150 countries

With such widespread interests, this sportswear company faced the very real prospect of being out of compliance with anti-corruption laws somewhere, at least some of the time. It had no way to screen vendors, had weak systems for identifying and mitigating risk, and little sense of where spend-related risk was the highest.

Our solution: A holistic approach to keeping corruption at bay and compliance on track

Genpact designed and built a full vendor-screening process and compliance framework with built-in data analytics to mitigate corruption risks. We also formulated guidelines to address key gaps and applied a continuous anti-corruption monitoring system for high-risk spend.

The impact: A vendor blacklist that showed lawmakers this firm took anti-corruption seriously

Thanks to the framework, the company identified twenty-four potential vendors, with whom they had business transactions worth $10 million, to blacklist.