- Point of view

Procurement platform implementation: Bridging the gap to procurement transformation

You've put in the work to transform your procurement processes and pushed the big red button to go live with your new procurement platform. So, now you can sit back and realize the benefits, right?

Unfortunately, too many CPOs don't see the results they expect from procurement platform transformation. This point of view looks at the business case for upgrading platforms, why these projects normally fail, and what needs to be done differently to ensure success.

Visit our sourcing page to find out more about our procurement practice.

Download the full point of view here.

Why transform procurement platforms?

The current business environment is tough. And it's made more complicated by mergers and acquisitions, digital disruption, and new challenger business models. Organizations must continually look for ways to find value and fuel growth.

Business strategy continues to demand improved cycle times and reduced operating costs in order to deliver the next generation of spend and efficiency benefits. CPOs are focused not only on efficient procurement transactions and global category integration, but also on innovation and re-engineering entire value chains.

A successful procurement platform implementation is one way to achieve these goals. When properly delivered, platform implementations support a CPO's vision of creating a world-class procurement organization and having end-to-end control and visibility of procurement processes. It should drive value creation, value capture, and value retention as its main outcomes.

Why do platform implementations fail to deliver results?

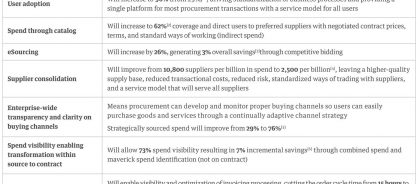

We work with many clients who have launched new procurement platforms. They expected processes to be transformed by the power of digital, a quantum leap in effectiveness, spend savings, and improved end-to-end process control and efficiency. Unsurprisingly, many of them have been underwhelmed by the results. One CFO, during a program review 12 months in, announced, “Our business case clearly stated significant incremental benefits from platform X's deployment. But based on this recent assessment, I can't see any material change – let alone our business outcomes being achieved". Based on best-in-class procurement metrics, these are the expected benefits from platform implementation for indirect procurement.

Unfortunately, mimicking existing complex processes that were neither lean nor streamlined, coupled with ineffective change management, led to a number of issues. Users complained that “the system isn't like Amazon," that too many of the requisitions are free text, and that the catalog content is sparse and doesn't cover the scope of materials needed. A large number of suppliers needed connections to the system in order to automate the invoice process.

Rather than seeing savings and efficiencies from the platform implementation and focusing subsequent investments on performance and innovation, investment had to be directed toward fixing this platform implementation. The necessary groundwork hadn't been laid before the platform was launched and it needed a rapid course correction in order to start to provide some of its expected benefits.

There are six main reasons why platform implementations fail to deliver:

- A poor business case without enough quantitative and qualitative analysis on key business metrics and benefits

- Poor platform selection due to a limited understanding of the business processes, especially in finance and IT

- Poor systems integrator selection

- Poor resource planning for assigning internal owners and champions

- Lack of policies and business processes to lay the foundation for a platform implementation

- Lack of focused change management and adoption planning

Bridging the gap between platform implementation and procurement transformation

Most platform implementations focus solely on functional and technical design, with expectations that this is enough to deliver transformation. There are significant gaps in this approach that limit the true value of a procurement platform implementation.

We recognize that only 29% of platform implementations deliver the expected business case8 of driving 96% business user adoption9 and covering 72% of spend on contract. The remaining 71% of businesses end up investing further in platform implementation fixes – attempting to address issues sub-optimally over a significantly longer time period - or worse, pause a partial implementation resulting in added costs, compliance risks, and operational issues that become exacerbated over time.

Genpact's procurement transformation approach to platform implementation

A more holistic approach to platform implementation is required to avoid the six main reasons these projects don't deliver expected outcomes. For any business considering this type of implementation in an effort to transform procurement processes, we recommend a delivery framework with three core pillars:

- Process standardization and harmonization

- Functional and technical implementation

- Change management and adoption planning

Figure 1: Genpact's procurement transformation delivery framework for platform implementation

Without a solid understanding of the underlying business processes and process standardization, the technology solution will only sustain broken processes and limit the expected benefits. Change management and adoption planning are critical to ensure that these benefits materialize. Our three-pillar delivery framework consistently produces results that meet the CPO's vision and creates, captures, and retains value.

A three-phase approach

The tried-and-tested methodology we follow to optimize platforms consists of three key phases:

Diagnose: Baseline current processes, policies and procedures, and benchmarking to identify transformation and optimization opportunities that create value

Transform: Based on opportunities identified during the diagnostic phase, this phase builds a thorough transformation and change management plan to include process standardization, change management and adoption, and functional and technical implementation. This phase also enables value creation and capture

Govern: Set up a compliance and governance mechanism to ensure sustained value through metrics, ongoing health checks, dashboards, and a continuous improvement roadmap

The program's success is underpinned with strong program management that challenges the business, drives advocacy, and delivers an enhanced user experience. Value creation indicators are monitored during and after implementation to ensure that business case expectations and ongoing business outcomes are met, including on-time implementation, high adoption, and customer satisfaction.

Figure 2: Genpact's procurement transformation methodology

The program's success is underpinned with strong program management that challenges the business, drives advocacy, and delivers an enhanced user experience. Value creation indicators are monitored during and after implementation to ensure that business case expectations and ongoing business outcomes are met, including on-time implementation, high adoption, and customer satisfaction.

The advantages of a holistic approach

Organizations that effectively leverage process automation can achieve significant business impact in three key areas:

Business value is maximized by aligning procurement services with business needs, meaning 66% more savings overall and 71% lower order processing costs

- Spend visibility leads to sourcing opportunities producing 8-14% savings

- Proactive and reactive compliance guides transactions to the correct buying channels, achieving 2-4% savings

- Touchless procurement allows for self-service to access goods and services

- The cost of procurement services is minimized through higher productivity and less waste, leading to 26% fewer FTEs performing current roles

- Touchless procurement leads to fewer tactical sourcing events, producing 2-4% savings

- Invoice automation allows accounts payable by exception, achieving 2-5% savings

- Procurement relationship and engagement value for employees, customers, and suppliers rises, enabling 56% improvement in being viewed as a valued business partner

- Increased associate satisfaction

- Business units more open to working on cost reduction projects

- Purchasing viewed as a partner in budgeting and forecasting costs

By fundamentally changing the way procurement services are delivered, our approach transforms organizations by improving customer experiences, operational efficiency, agility, and business value contribution.

Grow profits, mitigate risk, and transform spend management with our strategic sourcing and procurement services

Footnotes

1. Key Issues Study, The Hackett Group, 2019

2. Coupa Business Value Engineering (BVE), 2019

3. World-Class Procurement: Redefining Performance in a Digital Era, The Hackett Group, 2019

4. Purchase to Pay Performance Study by The Hackett Group, 2015

5. World-Class Procurement: Redefining Performance in a Digital Era, The Hackett Group, 2019

6. Gartner Predicts, 2016

7. Coupa BSM Benchmarks, 2019

8. Revolutionizing eSourcing Adoption, VitalSmarts, 2015

9. Key Issues Study, The Hackett Group, 2019

10. Purchase to Pay Forum, The Hackett Group, 2018

11. Purchase to Pay Forum, The Hackett Group, 2018