- Point of view

The dawn of the age of AI in insurance

AI use cases and challenges to adoption

Artificial intelligence (AI) will change the face of the insurance industry over the next five to ten years. By automating routine tasks and augmenting decision making, AI will enable smarter risk selection and pricing decisions, root out fraud, settle claims more quickly, produce more accurate reporting and forecasting, and – most important of all – radically transform the customer experience.

AI lift off

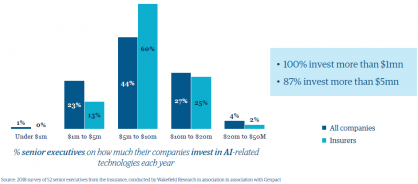

As insurers increasingly recognize its potential, attitudes toward AI have changed dramatically over the past year. In Genpact's second AI 360 report, we found that AI adoption is accelerating rapidly among insurers, with 87% of carriers investing more than $5m in AI-related technologies each year. This is more than both banking (86%) and consumer goods and retail companies (63%). Plans for AI are becoming more extensive, and all our respondents expect to adopt AI within the next three years. Figure 1 shows the scale of AI investment from insurers.

We explore the rise of AI across the industry, the use cases that will revolutionize claims and underwriting, and how you overcome the challenges when implementing this game-changing technology.

Point of view

Insurers’ investments in AI-related technologies each year

Claims. From customer pain to customer gain

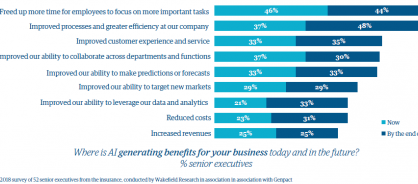

With its pivotal role in retaining customers, insurers are investing in AI to transform the customer experience by freeing up the time of experienced claims staff to focus on customers and making the process as frictionless, quick, and easy as possible. Add in the benefits of more accurate settlements, reduced loss adjusting expense, and more sophisticated fraud and subrogation detection, and it's easy to make the case for investment. Figure 2 shows where AI is generating business benefits for insurers both today and those forecast by the end of 2021.

The impact of AI today and in the future

Get your copy of the full report here:

There have already been some notable successes; in 2017, Lemonade used a chatbot to settle a claim in three seconds – a thousand times faster than its quickest claims adjuster.

In the longer term, the sky's the limit. Imagine a future in which you have a car accident and the car reports the claim for you. The sensors in your car will tell your insurer the nature of the damage and even how much the repairs will cost. Your insurer can then arrange a mechanic to start the repairs straightaway.

Similarly, if something goes wrong at home, such as a water leak, sensors connected to the internet can switch the water off remotely, minimizing damage and reducing the cost of a claim.