- Solution overview

Rethinking procurement target operating models

The foundation for standardization, productivity gains, and savings

What is a target operating model? Procurement professionals have heard it all before:

- You’re not delivering goods and services fast enough

- CFOs say the firm isn’t realizing the savings procurement promised

- Suppliers are put off by late payments

- Processes aren’t consistent

- Employees aren’t using costly new procurement tools and

- Automation isn’t working as promised

No silver bullet can solve all of these problems, but the right TOM - target operating model – one with a solid structure, correctly skilled staff, streamlined processes, and the right technology – can turn procurement into a sleek, efficient profit center.

How to develop a target operating model

When Genpact develops a target operating model project, our outside perspective shows you target procurement through a new lens.

The engagement typically lasts between eight and 14 weeks. Along the way, we benchmark to best-in-class companies and give you a heat map of problems to address.

The first step is to get a clear picture of the end-to-end target operating model components – a procedure that involves gathering and evaluating existing process maps and volumetric data. One goal is to assess how many handoffs take place between people and platforms. That's important, because the more handoffs there are, the more likely errors will occur.

The map also highlights the disparity in processes across sites, geographies, and business units because too much variation reduces enterprise-wide visibility. We talk to people performing similar functions in different ways to identify and understand why variations occur. Business and procurement stakeholders play an important role here, because their knowledge, information, and corporate insights ensure that follow-up discussions are relevant.

As soon as this first stage is completed, you'll have a comprehensive view of the as-is state.

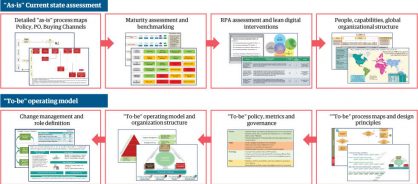

Figure 1: Key objectives of a target operating model review

Design thinking takes center stage

During the next stage, we conduct procurement-wide design-thinking workshops to outline the goals and steps toward achieving a target operating model geared to your specific business needs and to anticipate potential roadblocks. The aim is to develop an example of target operating model that standardizes processes, decreases variations, and reduces handoffs.

This is when we evaluate your existing technology.

Too often, companies invest millions in technology enhancements only to be disappointed when results don’t materialize. Understanding how each technology option works can help you shape processes to get the most out of them. For example, we’ll assess whether a technology upgrade is really necessary, whether enhanced automation would be enough, or whether you just need to simplify procedures so that people will use what you have.

Take a copy for yourself

Figure 2: Accelerate the transformation process by leveraging proven tools, frameworks, and benchmarks

Becoming a strategic business partner

The final step? Taking a hard look at your organization and asking whether the procurement operating model supports the business or is seen as a necessary evil. Do you have the right structure in place to become a strategic partner to your firm? Do you have the resources to staff up if necessary? Does your team have the right skills? Do you have incentives in place to encourage them to perform at their best? By asking the right questions, we help signpost the way for you to become a strategic partner, actively involved in long-term business planning and execution.

When we're done, you'll have a comprehensive transformation roadmap. We'll make recommendations based on impact and ease of implementation, including short-, medium-, and long-term opportunities to deliver best-in-class performance given existing initiatives and constraints. And we'll produce a business case that makes the argument for a procurement operating model change.

Example of our target operating model projects at work

- Sourcing savings – saved $200 million savings by automating processes for a global manufacturer that was significantly understaffed across its indirect strategic sourcing organization

- Operational efficiency – 40% efficiency gains for a global industrial manufacturer by standardizing global processes and driving automation across its direct procurement organization

- Restructuring – realized $50 million in savings for a global aviation manufacturer by decoupling direct target procurement activities and centralizing them into a center of excellence model

- Compliance – achieved $19 million in savings for a global aerostructure manufacturer through proactive and reactive compliance