- Solution overview

Cognitive buying: A smarter approach to purchasing

Making procurement user friendly

A procurement function does more than simply improve operational efficiency. It enhances the buyer experience, and enables the business to make better purchasing decisions faster and through the right channels.

Buying goods and services isn’t a core activity for most business professionals. That’s why they often take purchasing short cuts. They need something quickly and feel that going through the proper channels will just take too long. So they go straight to suppliers they know. They don’t see the value in doing otherwise.

That creates problems on several fronts. Maverick buying prevents procurement from seeing into the supply base and spend under management, making it harder to manage suppliers and negotiate better pricing. Accounts payable suffers, too: when people don’t order through preferred suppliers, the department has to work harder to match and track invoices, increasing the chance of multiple and incorrect payments. And without purchase orders, finance finds it difficult to forecast cash flow.

Bottom line: We estimate that non-compliant purchasing puts 1–2% of working capital at risk for every $1 billion worth of spend.

Take a copy for yourself

Challenge

Understanding maverick buying

Two issues help explain why users fail to follow procurement processes:

- Business units don’t have consistent policies and processes for procuring goods and services. Multiple ERPs and category management systems for different categories, such as travel and temporary labor, compound the problem. Users get confused about which policy to follow and which system to use

- Users say it takes too long to raise a purchase requisition and get approval, so they bypass the system and order from non-preferred suppliers

Two more help explain what prevents procurement from addressing these problems:

- Procurement systems are not intuitive. People aren’t comfortable using them and spend a lot of time searching for and ordering products

- There is no mechanism to check purchase requisitions up front, causing delays in requisition approvals and order fulfillment

Solution

Genpact Cognitive Buying Assistant: Procurement at whole new level

The good news: Companies can overcome these challenges with a simple-to-use ordering tool, Genpact Cognitive Buying Assistant (CBA), powered by Genpact Cora. It’s a smart assistant equipped with all the intelligence that business users need to guide them through the buying journey.

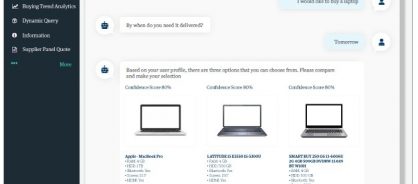

Genpact CBA uses natural language processing and machine learning to engage with purchasers (figure 1). People can specify their needs by answering a series of questions using structured or unstructured text. The tool interprets these inputs, offers guidance, and suggests product options based on the user’s profile. It then directs users to the appropriate buying channel, generates a purchase requisition and executes the actual purchase. But it doesn’t stop there. It also learns from user behavior so it can make even better recommendations next time.

Another plus: Genpact CBA integrates easily with existing procurement systems, such as Ariba, SAP, Coupa, or Oracle, and it builds on our operations insights and domain expertise.

Genpact CBA:

- Understands context and requirements using natural language processing

- Talks to the user to clarify needs, asks questions to better understand specifications, captures information through an interactive decision tree, and prepares the input for an effective search

- Guides the user to the right choice. It also gives a confidence score based on a specifications match, availability, past purchases and price

Impact

Beyond a superior user experience

Genpact CBA simplifies the user experience, so people don’t have to keep track of complex procurement policies and systems, and delivers the outcomes your stakeholders care about. Genpact CBA enables you to:

Genpact CBA in action as a user orders a laptop

- Make procurement easy and create a superior experience by removing the need for users to access multiple and complex systems

- Speed up transactions. By easily finding approved suppliers and products, users can complete purchases on the go

- Improve spend under management by up to a factor of four because it routes purchases through preferred suppliers

- Mitigate risks. Sourcing from pre-approved suppliers means you’re less likely to do business with vendors in financial or legal trouble

- Make your purchasing operations efficient. As users comply, the business can free up 1-2% of working capital for every $1 billion worth of spend

- It improves staff productivity by up to 60% because people have more time to focus on activities such as strategic sourcing and category management. They can even work on defining product/service requirements and finding the right suppliers

Case study

A prescription that cured a pharma’s procurement ills

Situation

Employees at a leading pharmaceutical company spent a lot of time searching for products and suppliers. They found the existing procurement system difficult to use, so they bypassed it and placed orders directly. When they did use the system, it took a long time to turn a purchase requisition into a purchase order — two business days.

Solution

We brought in a smart, automated approach: Genpact Cognitive Buying Assistant. Through Genpact CBA, users can detail their procurement needs just by responding to system queries, then confirming specification and shipping details. Genpact CBA does the rest. It guides the purchase requisition to the right supplier and executes the purchase.

Visit our sourcing and procurement page

Impact

Happier users. Faster purchasing. Buying channel adherence increased by up to 200% in just under 12 months — reducing supplier risk and leading to bottom-line savings. The time it takes for a purchase requisition to convert to a purchase order is down by over 70%. Buyers love the easy-to-use system and the speed with which their requests are processed.