- Case study

Delighting customers and advisors with automation in wealth management

Who we worked with

A leading global financial services firm with trillions in wealth management client assets.

What the company needed

- To delight its customers and advisors with real-time information and analysis on the held away investment assets of its institutional and private banking clients

How we helped

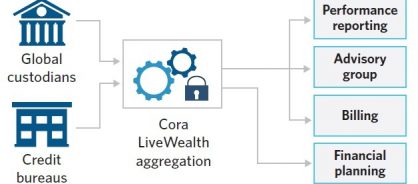

- Using Cora LiveWealth, we enabled the company to extract, aggregate, normalize, and analyze data from a variety of sources and provide holistic, comprehensive, real-time reporting with analytics tailor-made for each client

What the company got

- Improved customer and advisor satisfaction

- Detailed, on-demand performance reporting

- An automated and holistic view of its clients' total assets under management

- A 75% improvement in operational efficiency

For wealth managers, performance reporting conveys the tangible results of the investment decisions they've made in cooperation with their clients and helps them provide the best possible advice in the next planning cycle. That's why timely, accurate, and comprehensive performance reports are vital to maintaining client communications and trust. This is easier said then done. But automation in wealth management makes it easier.

Challenge

Data, data everywhere

Our client was managing 55,000 accounts across 300 different financial institutions. All of them had different data, formats, and architecture that didn't get along.

Without the technology to aggregate, extract, and process data from electronic and paper-based financial statements, the firm was forced to manually input data. That was expensive — and worse, it led to mistakes in billing and customer performance reporting. Data sources and formats of all kinds took a long time to process and analyze, too, which slowed down reporting.

To further complicate the process, four separate entities — two external partners, a team of internal analysts, and the financial advisors themselves — were working on fragmented architecture.

The firm's financial advisors weren't happy with the company's end-to-end performance reporting system—and neither were its customers. Data sourcing, aggregation, and performance calculations were sub-par, and multiple asset and transaction types added complexity.

Updating systems of record took far too long, and the team had little time to share insights. Financial advisors had to spend too much time covering for system and process gaps. That left little opportunity to engage with customers and provide value-added analysis, making it hard to maintain service levels and meet customer need.

Solution

Organize, synthesize, and normalize

The first step was to create a single platform with information on all customer segments that everyone could access. That way, the firm could tailor services and analytics to its own team—and to its customers.

In just 90 days, we rolled out the new aggregation and performance reporting tools. Cora LiveWealth, powered by the Genpact Cora AI-based platform, made this quick turnaround possible. Used by ses AI to transform wealth and asset management processes. It automatically gathers, extracts, and normalizes wealth management data analytics to improve the client and advisor experience for real-time reporting.

The product automated and streamlined three key areas: data extraction, data normalization, and data analysis. The result:

- Detailed on-demand performance reporting

- Enterprise dashboards across business lines

- The ability to aggregate consumer bureau information to isolate liabilities and build balance sheets

- Highly flexible asset classification schemas

- Personalized reports for management, financial advisors, and customers

- Operational efficiency improved by 75%

Take a copy for yourself

Figure 1: A schematic of the automated aggregation product developed on the Genpact Cora platform

Impact

An orderly operation across the enterprise, more satisfied advisors, and happier customers

Other benefits the company—and its customers—enjoyed:

- Advisors got a 360-degree view of their clients’ total assets under management, including outside assets. Managers saw a complete view at the enterprise, advisor, and client level, including daily transaction data

- Dynamic custom reports meant the firm could regularly update and personalize reporting for advisors and customers

- Enterprise-wide aggregation and reporting made compliance easier and improved operational efficiency by 75%

- Clients got a personalized, on-demand, and complete portfolio view that included outside assets

Now that the company’s reporting is up to speed, it can take business to the next level.