- Solution overview

OEM supply chains: connected dealer and assets as-a-service solution

An integrable solution that connects OEMs, equipment, and dealers to boost supply chain and service performance

The challenge: lack of visibility of customers' equipment service needs and inaccurate dealer planning

Today's original equipment manufacturers (OEMs) are having a tough time. Facing ever-higher customer expectations and competition, they must support their dealers' productivity and efficiency by preventing fill-rate issues and other collaboration concerns. They have to consistently provide the right parts at the right time, and service of the highest caliber.

But without supply chain visibility or the right tools, it's hard to accurately predict service and parts demand. Inventory can pile up and drain working capital. And when dealers, manufacturers, and distributors all use different systems, no one really has a complete picture of service-support or spare-part needs. Factor in an inaccurate installed base, limited tracking of equipment health, and complex repair logistics, and accurately predicting and planning for service and parts becomes almost impossible. This gets worse if there's no single view of inventory consumption, spare parts stock levels, or service claim management.

Take a copy for yourself

Our solution: a connected dealer and assets as-a- service program that unifies parts and service needs

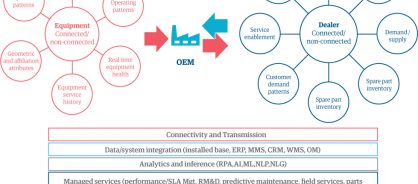

Genpact's connected dealer and assets service solution is a technology-enabled managed service model that links OEMs and their customers' assets to spare parts and service dealers, through a modular integrable solution.

At its core, it's a system that integrates dealers into OEMs' parts supply chain and customer equipment or assets. But its capabilities go further than that. It manages inventory, ensures asset uptime, and enables great customer service.

First, we work with clients to build scenarios around how to integrate the OEM supply chain network. These scenarios simulate partnerships, delivery models, service levels, and fill rates. Once we've assessed all the options, compared trade-offs, and settled on the right strategy, we deploy the digital solution - a control tower and dealer engagement platform.

Then we add in an IoT platform that connects assets to remotely monitor and coordinate service.

With this enhanced visibility, we can then provide services such as forecasting, planning, and managing orders, warranties and claims, make repair requests, and register service needs.

It's flexible too, working alongside some of our partners' technologies such as ClearOps, PTC, Salesforce.com, and Cora Orchestration (Figure 1).

Figure 1: A holistic connected dealer and service solution

The impact: happier customers all along the supply chain. Longer contracts. More revenue.

This solution has delivered significant results for our customers. One manufacturer saw its customer fill rate increase from 65% to over 85%. The firm also cut inventory obsolescence by 9%, cut repair turnaround time by 50%, and now solves 17% of maintenance issues remotely. What's more, the firm's first-time fix rate improved by 10-15% and downtime dropped by 15-40%.

It gives OEMs a true competitive advantage, with over 95% accuracy in dealer performance monitoring. With end-to-end inventory visibility across the network, it reduces excess and obsolescence. Plus, it provides a clear view of installed base health. All of this means happier customers, and so you'll get more revenue from parts and service and longer contracts.

Dealers can also expect higher product and service sales, longer service contracts, fewer obsolete parts, and faster inventory turnaround. And because equipment uptime and availability boosts productivity and lowers the total cost of ownership for their end clients' as well, it's a win-win for everyone.

Case study

A connected dealer solution cuts customer wait time for service parts at Terex

We partnered with Terex Corporation to implement a connected dealer inventory solution, an AWS-hosted global supply chain planning offering that connects its ecosystem of dealers to cut customer wait times. The results? A 95% increase in the order fulfillment rate and an 80% reduction in planning efforts with over 1,000 service opportunities every month.