- Case study

A connected approach to drive digital transformation in healthcare

How Ciox Health redesigned medical information management

Meet Ciox Health

Ciox Health is the US healthcare market leader for clinical information exchange. It supports providers and health insurance plans to securely collect, deliver, and reconcile over 40 million requests for medical information each year.

1.6k

locations

40m

requests/year

7k

active platform users

The vision

Ciox Health wanted to realize its vision for digital transformation in healthcare by:

- Revolutionizing how it shares urgent medical information securely by building CioxHealthSource, its cloud-based data-management platform

- Driving operational excellence and centralization across multiple locations

- Streamlining data management to boost customer satisfaction

- Transforming from a services company into an information technology business

Developing a partnership

- Ciox Health chose Genpact as its strategic partner to design, transform, and run CioxHealthSource, and source and deliver over half of the medical records exchanged in the US each year

- Cora Orchestration, Genpact's suite of intelligent business process management technologies, is core to the platform

Realizing the benefits

- With streamlined processes, HealthSource now delivers medical records faster, with greater accuracy and security

- Ciox Health can now provide abstraction and other data and analytics services to life sciences clients

The challenge

In the healthcare industry, information is power

For Ciox Health, every request for medical records represents a real person. And every data point informs the choices made by patients, providers, insurers, and life sciences companies. Each request is a vital step in a process that supports quality of life, treatment plans, and financial and legal decisions. Being able to access, review, and share accurate medical information at speed is essential.

From over 1,600 locations across the US, the company helps clients manage, protect, and leverage health information. For decades, health information management relied on disparate systems, complex authorizations, and paper-based records. It also required manual processes for tracking, pricing, and delivering medical records across a vast geographical footprint.

Want to chat?

As a forward-thinking company, Ciox Health recognized the need for digital transformation in health care and that health information needed to be digital information. “We needed to connect and streamline data management," says Pete McCabe, chief executive officer at Ciox Health. “But that is no easy task when you're dealing with incredibly sensitive medical information. Of course, protecting the privacy of patients is always our number-one priority."

To comply with regulations, Ciox Health must use secure methods to share medical information with an authorized requester in a timely manner. Medicare, a US federal health insurance program, can even penalize medical information providers for failing to meet ling deadlines. Addressing this requirement can be incredibly complex when "timely" is defined by national, state-level, and even contract-specific rules.

Ciox Health – formed in 2016 by unifying six regional companies – needed to adopt digital transformation in healthcare to transform how it delivered information to clients more quickly. It sought to increase productivity and efficiency by reimagining its processes and deploying a centralized solution across multiple locations.

The solution

A revolutionary medical information management system

In 2016, each unit inside Ciox Health relied on different processes and systems of record – a legacy from when it operated as various unique entities before consolidation. As a result, data-collection methods differed drastically across locations. It was also challenging to aggregate data and orchestrate reports for an accurate picture of performance.

Ciox Health turned to Genpact for support. A team of process consultants, technology architects, and Six Sigma experts visited multiple locations to understand the scope of the company's operations and make recommendations. To realize Ciox Health's vision, of a revolutionary medical information management system, we standardized and centralized data and processes. Plus, we embedded robotic process automation in certain tasks. These bots were built on Amazon Web Services – using solutions such as Amazon EC2, Amazon RDS, and Amazon Elasticsearch – so employees could refocus on higher-value work. After a successful pilot, this digitally enabled way of working was rolled out companywide.

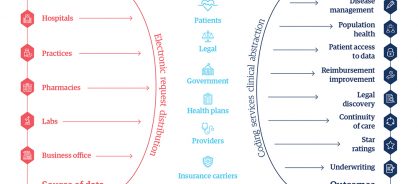

Case study

Having streamlined processes, the Genpact and Ciox Health teams worked together to use Cora Orchestration to build Ciox HealthSource, and deploy it across its 1,600 locations and 10,000 users. As a cloud-based data-management and workflow automation solution, HealthSource can scale to handle all the medical information exchanged in the US each year. This medical information management system also allows the company to provide analytical insights to all players in its ecosystem (Figure 1).

The demand for data through HealthSource

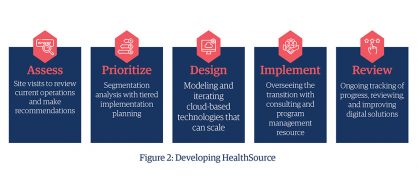

Genpact consultants created transition plans for implementing HealthSource to ensure every employee could adopt the new solution as soon as it debuted (figure 2).

Developing HealthSource

The impact

Agile, digital solutions for healthcare across multiple locations

After thorough planning, Ciox Health employees quickly adopted the solution. In the 12 months since implementation across the US, the platform now has over 7,000 active users (with a goal to reach 10,000) and processes 40 million information requests each year. This boosts customer satisfaction by making sure that authorized requesters receive their information faster and with greater accuracy.

With more parts of its business and operations managed through the HealthSource platform. Ciox Health can now redistribute its workforce across higher-value projects and services.

This is just the start of company's journey with a digital-first operating model.

“HealthSource is an essential part of our business strategy," says McCabe. “Having a fully scalable clinical data platform is key to improving information management for the US healthcare market and every patient that it serves. Working with Genpact helped us to create the foundation for the future."

The stakes for the future of digital healthcare are high. Three out of five hospitals and more than 16,000 physician practices in the US rely on the company – as do countless health insurance plans, law firms and, most importantly, the millions of patients those stakeholders serve. As Ciox Health enters the faster digital healthcare future, HealthSource will get the right data to the right people at the right time so every patient receives the care they need, exactly when they need it.