- Solution overview

Genpact's approach to intelligent automation

How automation complemented by human expertise and advanced digital technologies delivers exponential business value

Automation is an essential part of any digital transformation strategy. With the goal of removing manual processes, improving productivity, and reducing operational costs, many early adopters of automation used robotic process automation (RPA) to tame high-volume, rules-based processes that once consumed employee time and resources. Today, combining RPA with advanced digital technologies creates something even more powerful – intelligent automation.

What is intelligent automation?

Intelligent automation blends RPA with human expertise, process mining, orchestration, and artificial intelligence (AI). It marks an evolutionary step in automation, allowing you to:

- Apply automation within the context of your business and industry

- Perform analytical tasks based on unstructured data – at speed and scale

- Orchestrate processes between humans and machines across the enterprise

As a result, intelligent automation transforms end-to-end operations, improves decision-making, and supports seamless experiences.

At Genpact, we've refined our approach to intelligent automation by working with Fortune Global 500 companies. We're helping them reimagine critical processes and adapt to ever-changing business environments to deliver exponential value.

Take a copy for yourself

A multi-layered approach

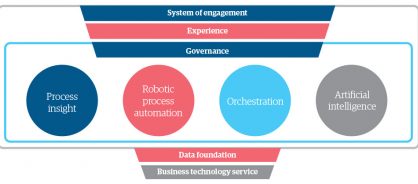

Intelligent automation requires an integration layer between new solutions and existing data and technology. This system of engagement connects humans to machines and data. This critical layer can manage multiple processes, disparate data, and legacy systems to create a unified user experience.

With this in mind, user experience should be the guiding principle behind automation. That's how you avoid automating for the sake of automating. Instead, you can make changes that help employees do their jobs more effectively and create more efficient and personalized services for customers and partners. When you think about automation through this human-centric lens, you deliver experiences that exceed expectations, inspire loyalty, and increase profits.

Governance is also essential. It ensures that intelligent automation performs as expected, uncovers reasoning behind outcomes, helps build trust in automation among employees, and protects your return on investment (ROI).

The other key components of an intelligent automation engine include:

- Process insights: Though initial process mining and discovery helps you find opportunities for transformation, continuous process insights lead to ongoing process performance improvements

- RPA: Bots automate rules-based processes that require structured data. By taking over routine and transactional activities, such as data entry, bots free human workers to focus on higher-value, more strategic work

- Orchestration: Dynamic workflows enable human workers, RPA bots, and machine learning (ML) to work together. For instance, if there's a transaction that a bot can't process, a human is notified to find a solution. In this way, bots can self-manage exceptions to eliminate bottlenecks and speed up operations

- AI: Using AI, you can extract and process unstructured information into a structured format. Conversational AI can understand customer intent and handle interactions. These cognitive solutions are what make automation truly intelligent

However, you cannot achieve intelligent automation without a strong data foundation. You need data engineering to source, clean, and prepare data and to ensure that your core business technology services – such as enterprise application services and cloud databases – work in harmony with automation.

When you bring it all together, you'll have created an intelligent automation engine (figure 1).

Figure 1: The intelligent automation engine

Thankfully, intelligent automation does not require a complex implementation. Using pretrained AI accelerators – reusable building blocks with relevant process data and business knowledge built in – you can quickly automate common yet critical tasks to realize the benefits of intelligent automation sooner.

How it's done

Here's how Genpact works with clients to unlock the power of intelligent automation:

- Identify which processes to automate using process mining and industry-specific process knowledge

- Refine and redesign processes as needed, before automating

- Build foundation with orchestration and RPA

- Leverage unstructured data and add intelligence through AI and ML

- Use pretrained AI accelerators to accelerate implementation

- Handle service interactions through conversational AI

- Continually deliver performance insights using a data-on-demand approach

- Build in process transparency and governance

- Make additional automation choices that improve end-user experiences

- Continuously improve to realize greater benefits and ROI

Our digital and industry expertise

Our intelligent automation team includes hundreds of process and technology consultants, as well as thousands of data scientists, RPA and orchestration experts, and data engineers.

Using this expertise, we developed Genpact Cora – our integrated digital business platform that brings people, process, and technology together for intelligent digital operations. A key part of Cora is Cora Orchestration, our dynamic orchestration layer that manages the flow of work across unified end-to-end processes.

Across every industry, Cora can help you streamline and transform critical business functions. We offer a variety of additional solutions including:

- Cora APFlow to automate the accounts payables process and identify ways to accelerate cycle times and improve supplier management

- Cora ARFlow to streamline order-to-cash operations, optimize workflows, and improve collections for increased cash flow

- Cora FinancialControllership to gain real-time access to financial data and accelerate the financial close and reconciliations process

Cora is further enhanced further by the capabilities of our best-in-class technology partners, such as Microsoft Azure and Amazon Web Services. We also work with RPA experts including Automation Anywhere, Blue Prism, and UiPath, and process mining experts such as Celonis. And finally, we partner with technology leaders in specific process areas such as finance and accounting, supply chain, and procurement.

Figure 2: Genpact Cora partner ecosystem

Case study

Helping one of the world’s largest retailers

What the company needed: To simplify thousands of complex legacy applications by streamlining and automating the invoicing process to increase productivity.

How we helped: Designed and built an ML system based on natural language processing, smart analytics, RPA, and AI to simplify processes, reduce cycle times, and deliver a better employee experience.

What the company got: Transformed global business services built on a scalable intelligent automation solution. Real-time performance measurements and controls have led to a 70% productivity increase.