- Point of view

Stronger together: How integrating procure-to-pay delivers bottom-line impact

A frustrated CFO meets with the accounts payable (AP) team to find out why suppliers are complaining about erratic payments and threatening to delay deliveries, increase prices, and reduce payment terms. They need to know what's causing these problems and how to fix them, but aren't sure where to start. To get to the root causes, they'll need to collect data, analyze current performance, and benchmark against best practices. What data needs to be collected? Which metrics need to be measured and why? These issues were meant to have been solved by the recent procurement platform implementation, but nothing's changed.

An integrated procure-to-pay (P2P) program can solve these challenges, with Genpact benchmarks showing that on average, organizations can increase productivity by 20-25% by implementing this model.

This point of view explores how the actions of requisitioners and the buying organization can improve AP's ability to pay on time, and which metrics AP should use to measure performance.

The case for change

The lack of an integrated P2P strategy costs companies money and lengthens end-to-end cycle times. Add in the amount of rework and manual touch points because of the low adoption of digital technologies and it's clear this is an area ripe for transformation.

Most organizations tend to have separate procurement and AP teams, with AP typically reporting into finance due to the accruals and reporting aspect of its work. This split in accountability leads to:

- Fragmented processes with a lack of end-to-end visibility and transparency

- Overall compliance and general accountability issues

- Separate strategies

- Inconsistent metrics and reporting for finance and procurement

Ultimately, this siloed approach leaks revenue and limits the performance of the overall P2P function. Integrating P2P across procurement and finance will boost its effectiveness, and the transparency of shared goals, data, reporting, and scorecards will facilitate and sustain this change.

Integrating P2P will also provide the foundation for the expanded use of predictive and prescriptive analytics to deliver continuous improvements, agility, and efficiencies.

Take a copy for yourself

Procurement's role in AP effectiveness

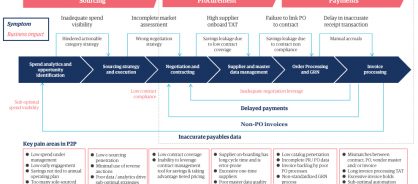

Genpact's internal benchmarking figures suggest that 40-45% of AP problems stem from ineffective sourcing and procurement processes that flow downstream with unintended consequences (figure 1).

Figure 1: The link between upstream and downstream P2P processes

Downstream problems include late payments, unhappy suppliers, the loss of early payment discounts, and transaction rework – all lengthening the payment cycle. A poor payment history can lead to credit holds, and suppliers withholding critical goods and services. COVID-19 has further emphasized the business-critical impact these issues drive. With current market conditions including shortages of raw materials and/or logistics network capacity constraints, buying organizations with the best supplier management and payment are more overtly being prioritized for supply over their competitors.

P2P is also hampered by:

- A poor user and supplier experience

- A higher cost-to-serve from rework

- Suboptimal cash flow

- Poor decision-making due to lack of end-to-end governance, accountability, and shared data

Organizations are working to strengthen their cash positions so that they are more resilient to market fluctuations, and while delaying payments is an often used strategy, it comes at the cost of reputation and damages relationships, too. However, connecting AP with upstream procurement and downstream treasury will generate insights that will help cash initiatives.

Measuring the benefits of P2P integration

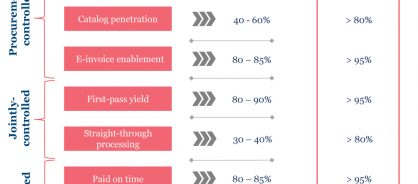

The full value of integrating P2P can be measured by the potential improvement in upstream and downstream performance metrics. These can be quantified to show the incremental value above and beyond procurement and AP operating in silos (figure 2).

Figure 2: Desired outcomes of integrated P2P driven by key metrics

To understand how these metrics can be improved, finance and procurement teams must understand each other's metrics and how they interact and impact their success.

Procurement-controlled:

- Purchase order (PO) penetration: PO transactions as a percentage of total transactions (not including approved non-PO transactions). This metric is impacted by a lack of no PO/no pay policies and enforcement, and transactions being allowed without POs. Inadequate automation, buying channel definitions, and instructions all hamper performance as they lead to manual requisitions, rework, and data integrity issues. The cost impacts include rework, late payments, early payment discount loss, poor supplier relationships, and credit holds due to late payments. Perception of performance here can be significantly skewed if the proportion of "after-the-event" POs are not explicitly reported on.

- Catalog penetration: Purchases made on catalog as a percentage of total transactions. This metric is impacted by procurement strategy, buying channel strategy, quality of guided-buying rules/forms/templates, and enforcement of buying against these strategies. The cost impacts include loss of transaction efficiency and increased supplier prices/costs due to rogue spend.

- E-invoice enablement: Suppliers that are e-enabled as a percentage of total suppliers. This metric is impacted by supplier enablement strategy as well as the business case justifying the costs against savings. The cost impacts include rework, late payments, early payment discount loss, poor supplier relationships, and credit holds due to late payments. With COVID-19 driving a heightened sensitivity to cashflow, CPOs must ensure these issues do not lead to downgrades in their critical suppliers' customer preferencing, which in turn could impact the buying organization's ability to sustain the security of supply, and indeed the quality of raw materials and ingredients supplied.

Jointly controlled:

- First-pass yield: Percentage of invoices that pass automatically into the payment system and require no manual intervention. This metric is impacted by PO and invoice automation, low catalog penetration, missing invoice information, incorrect vendor information, and/or failure of optical character recognition to scan invoice information – all of which cause rework. The cost impacts include potential loss of early payment discounts as well as rework costs and time.

- Straight-through processing: Touchless AP, or the percentage of invoices that get paid without manual intervention. This metric is impacted in the same way as first-pass yield and shares the same cost impacts.

Finance-controlled:

- Paid-on-time: Percentage of suppliers paid within the negotiated payment terms, with the ultimate goal being touchless or invisible AP. This metric is impacted by invoice-to-PO mismatch, wrong vendor master data, and automated invoice and first-pass yield fails – all of which cause rework. The cost impacts include loss of early payment discounts, rework costs, poor supplier relationships, and credit holds due to late payments.

- Percentage inquiries: If P2P processes work as planned, the percentage of queries from vendors and users should decrease. This metric is a leading indicator of the overall health of the P2P process.

Genpact's framework for integrated P2P

The improved metrics that we've seen in our work with clients clearly demonstrate that integrated P2P delivers outcomes beyond the traditional operational and compliance metrics measured in each silo. The prerequisite for this transformation is that upstream processes must be correctly structured and configured to drive these improvements into downstream operations. Aligning P2P outcomes with business drivers and fixing the issues and root causes by measuring them against the right metrics will transform P2P, unlocking significant value, as demonstrated in our work with a Fortune 500 medical equipment and healthcare company.

Our framework structures key integrated P2P outcomes across three pillars (figure 3).

Figure 3: The benefits of integrated P2P aligned to business outcomes

Elevated user experience: User experience drives the effectiveness of P2P. The ease with which end users and suppliers can interact with the system will enable adoption, improve productivity, and improve the overall quality of procurement. This provides an additional benefit to upstream strategic sourcing by reducing the duration of spend analysis and strategic sourcing.

Enhanced value: Paying suppliers on time within negotiated terms boosts procurement's ability to negotiate better terms while preventing credit holds and loss of supply if suppliers withhold critical goods and services. It also provides a predictable cash flow in terms of days payment outstanding.

Improved decisions: Better data visibility and transparency improve governance and accountability of the P2P process and facilitate efficient and effective decision-making.

Tangible bottom-line results come from the harmonization of integrated P2P processes.

Getting started

To start integrating P2P processes, organizations must know what their specific AP problems are and which metrics need improving. Only then can processes be redesigned and streamlined to address these issues and tie them to business objectives. The focus should be on improving the user experience, standardizing processes and policies, and reducing costs. Change management also plays a vital role in encouraging user adoption.

This approach ensures successful P2P integration to deliver significant bottom-line impact. Improved upstream sourcing and procurement productivity aids the ability to streamline downstream requisitioning through POs and payments and builds on these results.